Share this

Why Batteries Win in ERCOT’s New Market Design

Note: Blog post published November 7, 2025.

On December 5, 2025, the Electric Reliability Council of Texas (ERCOT) will launch Real-Time Co-Optimization + Batteries (RTC+B), perhaps the most sweeping market redesign in its history. This transformation will touch virtually every aspect of the market, from energy to ancillary services, introducing a more dynamic, efficient, and integrated approach to market operations.

For battery operators, in particular, RTC+B is a game-changer. The redesign recognizes batteries not as separate charging and discharging assets but as unified energy storage resources (ESRs), allowing operators to more easily participate simultaneously in energy and ancillary services markets. This shift will enable batteries to capture more value, optimize dispatch, and contribute to overall market efficiency in ways that were impossible under ERCOT’s legacy design.

Want to learn more about upcoming changes to ERCOT?

RTC+B Market Overview

ERCOT’s RTC initiative has been years in the making. It was initially focused solely on creating a real-time, co-optimized market that would simultaneously clear energy and ancillary services, accounting for each resource’s capabilities and system conditions to determine the most efficient dispatch. With New England ISO’s (NEISO) introduction of a co-optimized market in March 2025, ERCOT will be the last Independent System Operator (ISO) to make this shift.

ERCOT paused its RTC initiative in the wake of Winter Storm Uri. The project was restarted in 2023, adding the battery (+B) component to reflect the rapid growth of battery energy storage capacity in ERCOT.

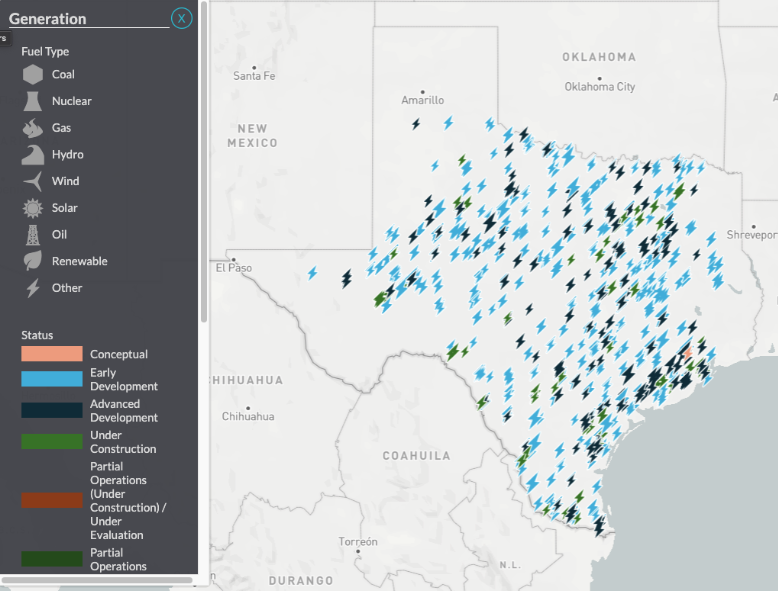

Texas is one of the fastest-growing battery storage markets in the country, second only to California in terms of installed capacity. In fact, ERCOT nearly doubled its battery capacity between 2023 and 2025 and is now approaching 10 GW (see image below).

Source: Yes Energy’s Infrastructure Insights Module. Battery projects in development or under construction in ERCOT as of April 29, 2025.

Even more capacity is in the pipeline. Yes Energy is currently tracking over 1,100 battery projects, totaling 180.5 GW, under construction or in development across the region.

Market Design Overhaul

RTC+B fundamentally reshapes how ERCOT manages energy and ancillary services, creating a market that’s more dynamic, efficient, and aligned with modern resources like batteries.

At the heart of the redesign is the replacement of legacy constructs such as the Operating Reserve Demand Curve (ORDC) with Ancillary Services Demand Curves (ASDCs). These curves provide product-specific pricing for reserves – including regulation up ECRS and spinning reserves – enabling batteries and other flexible resources to see relative value signals and prioritize offers accordingly.

The RTM – Before (Pre-RTC)

Source: Yes Energy

Under RTC+B, energy and ancillary services are co-optimized in the real-time, meaning ERCOT simultaneously clears both energy and reserves through the SCED rather than relying on a separate ORDC process to clear reserves. Co-optimization already exists in the day-ahead in ERCOT and will continue after RTC+B.

This real-time co-optimization ensures that resources are dispatched efficiently across both markets, with the goals of improving overall market efficiency, reducing real-time energy costs, and narrowing day-ahead to real-time price spreads over time.

The RTM – After (Post-RTC)

Source: Yes Energy

ERCOT will also introduce virtual offers for ancillary services in the day-ahead market, which will increase liquidity by allowing more resources, including batteries, to participate flexibly.

To prepare for these changes, ERCOT conducted market trials in three stages: open-loop testing, closed-loop testing, and final go-live validation. These trials allow participants and market operators to observe clearing prices, test new reports, and ensure that the transition to RTC+B will be as seamless as possible.

ERCOT Batteries Take Center Stage

Under ERCOT’s legacy framework, batteries were split between charging and discharging functions, treated as two separate resources with separate datasets in ERCOT’s systems. This “combo model” created extra complexity for resource owners, requiring manual processes to achieve consistency across operating plans, telemetry, and bid curves. RTC+B eliminates this dual structure, replacing it with a single energy storage resource (ESR) designation that unifies a battery’s operations into one resource type.

Batteries will submit a combined Energy Bid-Offer Curve (EBOC), which integrates both charging and discharging into a single market signal. Negative EBOC values represent charging, allowing batteries to signal both their willingness to consume and supply energy. A Low Sustained Limit (LSL) will replace the Maximum Power Consumption (MPC) parameter, enabling operators to define realistic operational constraints within the unified framework.

This structure allows batteries to participate dynamically across both energy and ancillary services markets, supporting real-time co-optimization. Battery operators can also adjust day-ahead awards in real-time based on updated system conditions, pivot quickly between market products, and respond to five-minute reserve updates.

RTC+B will also transform how participants interact with ERCOT through data and operational reporting. Under the new framework, resources, including batteries, will integrate EBOCs, LSLs, and regulation signals into ERCOT’s new market-clearing and settlement processes.

These capabilities not only give operators unprecedented flexibility and revenue potential but should also improve market liquidity, enhance competition, and help moderate price spikes for both energy and ancillary services.

In other words, with RTC+B, batteries are no longer just flexible resources. They become central drivers of ERCOT’s next-generation market efficiency.

Market Monitoring and Preparation

We’ve been working in the ERCOT market since 2008. We’ve seen ERCOT evolve, adapted through every market redesign, and helped our customers succeed at each step.

To support participants, our Market Monitoring team is tracking these changes, providing critical market intelligence to prepare our Product and Data Engineering teams for updating data pipelines collecting new reports. This ensures our customers operating in ERCOT can maintain seamless participation, more accurately signal their resource capabilities, and fully capture revenue opportunities under the new market design.

Yes Energy’s market monitoring team is also attending stakeholder meetings, reviewing market trials data, and assessing upcoming report changes to help customers understand impacts on pricing, ancillary services, and energy market participation.

The team is collecting and evaluating high-priority market trials data, including open-loop and closed-loop testing results, so that when RTC+B goes live in December, existing data pipelines remain seamless and critical reports are fully integrated. Customers can access ongoing updates, surveys, and guidance through Yes Energy’s public RTC+B resources and internal help system.

By maintaining a close pulse on ERCOT’s market design changes, Yes Energy aims to help battery operators and other market participants navigate the transition with minimal disruption and maximize the opportunities enabled by the new real-time co-optimization framework.

Looking Ahead

With RTC+B, batteries move from being supporting players to central drivers of ERCOT’s next-generation market. By unifying charging and discharging into a single energy storage resource, introducing realistic operational bids and offers through the new EBOC, and integrating along with real-time co-optimization across energy and ancillary services markets, the redesign unlocks new operational flexibility and revenue potential.

As the December 5 go-live approaches, battery operators who understand and leverage these changes will be well-positioned to capture value, enhance market efficiency, and shape the future of the Texas electricity system.

Want to dive deeper into how this program can impact your organization?

Tune into our on-demand webinar, ERCOT RTC+B Explained: How to Prepare.

About the author: Portia Gilman manages the Market Monitoring Team, a group that stays abreast of the ISO energy markets so you don’t have to. The team serves internal and external clients with regulatory market knowledge and subject matter expertise on the impacts to Yes Energy’s clients, data, and the energy industry as a whole. Previously, Portia was an analyst for ISO New England’s internal market monitoring group for over six years, specializing in compliance, price formation, SCED dispatch, and capacity market economics.

Share this

- Industry News & Trends (120)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (23)

- Live Power (23)

- Renewable Energy (18)

- Risk Management (18)

- Data Scientists (17)

- ISO Changes & Expansion (17)

- Energy Storage / Battery Technology (16)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- AI and Machine Learning (2)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)