Share this

ERCOT and ISO-NE Introducing Energy Market Co-Optimization in 2025: What to Know

by Portia Gilman on Feb 10, 2025

In 2025, major market design changes are coming to the ERCOT and ISO-NE markets: co-optimization of energy and ancillary services.

What does this mean for you? These projects will introduce new market designs and changes to existing market data, bringing efficiency and reliability benefits to the market clearing software.

Our team is tracking these changes closely to prepare for implementation in our products when these markets go live – and to keep you abreast of any updates.

Let’s explore what co-optimization is, which markets have it, why it’s beneficial, and what it means for you.

What Is Co-Optimization of Energy and Ancillary Services?

Co-optimization is the process by which megawatts (MW) awarded in the ISO’s market clearing process are shifted between energy and ancillary services to find the optimal mix between the two services that minimizes production costs (or maximizes profits) across the system.

There is a one-to-one tradeoff between providing energy and providing reserves – the same megawatt can’t provide energy and reserves simultaneously. Similarly, the pool of generation capacity that can provide either energy or ancillary services is a fixed pie.

Co-optimization considers the entire pool of generation resources qualified to provide both energy and reserves and optimizes the allocation of awards to each product within that pool.

How does it work when energy and ancillary services are not co-optimized?

In that scenario, the allocation of energy and ancillary service awards are separate processes. They occur without considering the tradeoff between energy and ancillary services in the market clearing process.

Which Markets Have Co-Optimization?

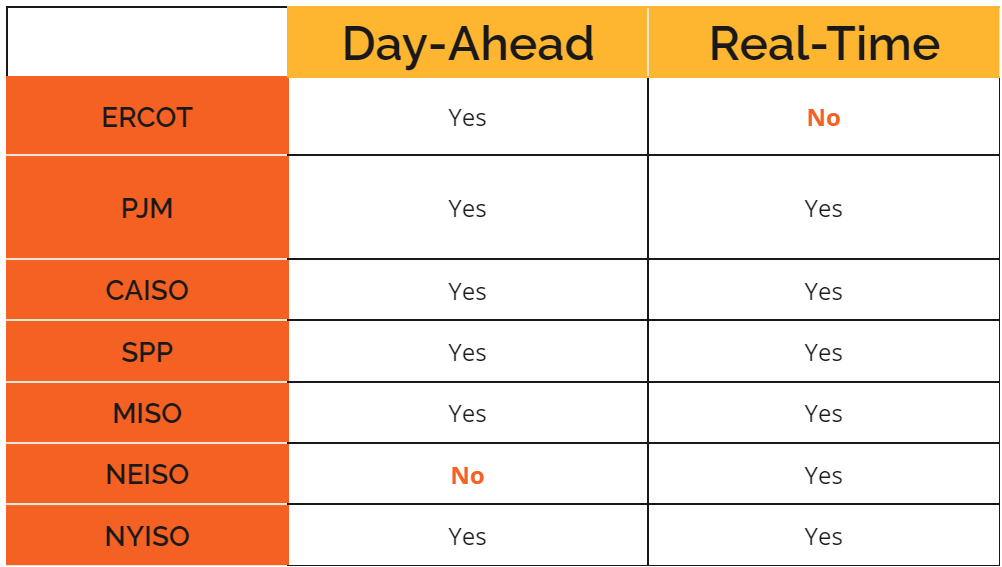

Co-optimization can occur in the day-ahead market (DAM), the real-time market (RTM), or both. Most Independent System Operators (ISOs) and Regional Transmission Operators (RTOs) operating in organized markets have some form of co-optimization in both the DAM and the RTM, with two exceptions.

ISO New England (ISO-NE) co-optimizes ancillary services with energy in its real-time market (RTM), but not its day-ahead market (DAM).

In the Electric Reliability Council of Texas (ERCOT), it’s the opposite, where the two markets are co-optimized in the DAM but not the RTM.

Day-Ahead and Real-Time Markets With Co-Optimization (As Of February 2025)

Source: Yes Energy

Fortunately, both ERCOT and ISO-NE currently have multiyear co-optimization projects underway estimated to go live next year.

ERCOT’s Real-Time Co-optimization Plus Batteries (RTC+B) project is estimated to launch in December 2025.

Meanwhile, New England’s Day-Ahead Ancillary Services Initiative (DASI) is going live in March 2025. (We’ll dive into these more later.)

What Are the Benefits of Co-Optimization?

A key facet of co-optimized market clearing is that the resulting clearing prices take into account the opportunity cost of providing one service versus the other.

Co-optimization means generators are made whole to their next best opportunity.

For example, if the locational marginal price (LMP) is $40 and the price of ancillary services is $60, then the participant would prefer to provide more ancillary service and less energy, all other things being equal.

Co-optimization allows the market clearing software to consider the lost opportunity of providing energy instead of ancillary services in the LMP calculation, making the provider whole to that next best opportunity. The tradeoff goes the other way too, where the co-optimized clearing price for ancillary services will account for the lost opportunity cost of providing energy.

Co-optimization allows generators to provide their most profitable product first, getting more megawatts allocated to that more profitable service. This both maximizes profits and minimizes overall production costs by finding a more precise least-cost solution.

What are some other benefits?

Co-optimization can help reduce out-of-market payments such as uplift and lost opportunity cost payments by providing price signals that better reflect the value of energy and ancillary services. More economically accurate clearing prices help make generators indifferent between providing one product over the other, increasing the quality, performance, and reliability of those services in the market.

Better prices also provide better signals for investment.

What’s an Example of Co-Optimization?

To better understand the mechanics of co-optimization, recall that all ISOs have a two-market settlement system. The DAM produces financially binding schedules for production and consumption that carry forward into the RTM. The RTM balances the deviations between the DAM-scheduled quantities of power and actual real-time load.

Market conditions constantly change, and many changes can happen between the time that the DAM clears as of 10 or 10:30 a.m. the day before the operating day and the real-time operating hour.

What does this mean? It means that in the DAM, energy offers must equal energy bids at the point of intersection where the supply and demand curves cross.

By contrast, the RTM is clearing updated real-time supply curves against the actual real-time load that the ISO or RTO must meet.

The day-ahead market produces schedules that are financially binding, not physically binding. This means the real-time market accounts for any deviations between the economic DA schedules and the actual market conditions that manifest, including the generation and load that show up in the RT. (The DAM solution must also be physically feasible – power must be able to actually flow. Therefore the DAM also takes into account physical elements such as grid congestion and transmission constraints.)

This is why the RTM is sometimes referred to as a “balancing” market. The RTM clearing software clears the balance, or deviations, between the DAM schedule and real-time load.

Most markets clear ancillary services and energy co-optimally in both the DAM and the RTM. New England has been an exception – until the development of the DASI. Prior to this market change, ISO-NE did not have ancillary service products in the DAM.

Conversely, ERCOT’s ancillary service performance in the real time has been based on the DAM-cleared prices and quantities.

A Deeper Dive into This Example

Let’s consider a simplified example of co-optimization. Suppose there are two generators that can offer energy and ancillary services into either the day-ahead market or real-time market or RTM. Let’s say that Generator A’s offer prices for both energy and reserves are lower than Generator B’s offer prices.

In a scenario that isn’t co-optimized, the market will clear the energy from Generator A first because it’s offering its energy at a lower cost. Separately, the market will then incorporate the ancillary service requirements and also clear reserves from Generator A before Generator B because those offers are also lower cost.

Now imagine that Generator A gets fully committed for all its capacity. When that happens, the next generator that can provide an additional megawatt of energy will set the LMP, which is Generator B. Remember that Generator B has higher offer prices for both energy and reserves.

Co-optimization asks the question – what if we could get more energy from the cheaper generator, Generator A?

Doing so would require reducing Generator A’s ancillary services award so that it can supply more of its lower-cost energy instead. That reduced portion of the ancillary services award then shifts to Generator B, which is offering the ancillary service at a higher cost.

Even so, this will become a more optimal solution when the larger supply of lower-cost energy offsets the more expensive ancillary services from Generator B. The final co-optimized solution considers the tradeoff between energy and reserves and will result in a lower-cost solution overall for the two products.

ISO-NE’s DASI to Go Live March 2025

In January 2024, FERC approved ISO-NE’s proposal to not only co-optimize ancillary services in the DAM but also to create a brand new day-ahead ancillary services market. The DASI, going live in March 2025, includes a novel new “call option” settlement design to meet the operating reserve and load forecast requirements in the DAM.

Recall the earlier discussion of market clearing in the day-ahead market versus the real-time market. The DAM solution, which clears based on supply and demand, may or may not be sufficient compared to the day-ahead load forecast. This divergence can lead to supplemental commitments by the ISO after the DAM closes.

This phenomenon occurs in all ISOs, not just New England. Supplemental commitment is a suboptimal “out-of-market” action the operator takes to ensure that enough generation is committed in time to meet the estimated load forecast as the market moves into the RT.

In all ISOs, procuring enough capacity to meet the forecasted load is a constant challenge.

ISO-NE’s DASI design is a voluntary market with a unique design.

Participants offer to sell ancillary services in the DA, and the DAM clears those offers through co-optimization. For every MWh of day-ahead ancillary service offered and cleared, the seller earns the DA ancillary service clearing price. They will also face a potential “close-out” charge equal to the difference between the real-time price and the ISO-determined strike price.

To avoid a loss, the seller must respond to higher-than-expected RT LMPs and produce energy in RT to earn revenues that offset the close-out charge.

The goal is to incentivize generators that offer and clear the DASI products in the DAM to produce energy in real time when conditions are tight and RT energy prices “call” on the resource to perform.

New England’s design includes four new day-ahead ancillary services products: Day-Ahead Ten-Minute Spinning Reserves (DA TMSR), Day-Ahead Ten-Minute Non-Spinning Reserves (DA TMNSR), Day-Ahead Thirty-Minute Operating Reserves (DA TMOR), and a new product called Day-Ahead Energy Imbalance Reserve (DA EIR).

Source: Yes Energy

The day-ahead EIR will contribute to satisfying the difference between the day-ahead market clearing and the load forecast and will generate its own market price called the Forecast Energy Requirement (FER) price.

ERCOT’s RTC+B Project to Go Live December 2025

ERCOT’s RTC+B project originally began years ago and was delayed in 2021 after Winter Storm Uri. The project came back to life in 2023 with a go-live target for 2026. In September 2024, ERCOT announced that the project is ahead of schedule with an anticipated go-live for December 2025.

The RTC+B project will co-optimize energy and ancillary services in the RTM, allowing ancillary services to be continually reviewed and adjusted in response to changing market conditions and allowing the resulting efficiencies to flow to all market participants and the market as a whole.

Besides the benefits discussed, the project aims to improve ERCOT’s shortage pricing and reduce shortages in operating reserves. RTC+B is expected to reduce reliability unit commitments and similar out-of-market actions, help with congestion management, and increase competition in the ancillary services markets, particularly the non-spin and regulation-down products that have historically raised concerns about the existence of market power in those markets.

All these benefits are expected to help the region through its transitioning resource mix.

That’s not all – this project will include changes that go beyond the scope of co-optimization in the RTM. It will also include some changes to the DAM, including the addition of ancillary service demand curves to improve the efficiency of the DAM clearing.

Currently, ERCOT procures ancillary services in the DAM according to administratively set requirements, which means there isn’t a bid curve. The requirements are allocated back to load-serving qualified scheduling entities (QSEs) according their obligated quantities.

The project will also include a suite of changes to battery modeling, the “B” in “RTC+B.”

Currently, batteries are modeled separately as loads (for charging) and generators (for discharging). The RTC+B project will create and incorporate a new model into the software that will model batteries as a single resource instead of two separate resources.

There’s also a need to properly account for battery state of charge (SOC) in the market clearing software, especially as the number of batteries on the system continues to grow. RTC+B will include changes that incorporate battery SOC into the market clearing process.

Conclusion

In summary, co-optimization occurs when MWs awarded in the market clearing process are shifted between energy and ancillary services to find the mix that minimizes production costs (and maximizes profits) across the system.

The benefits of co-optimization include lower production costs, more robust price formation (which creates price signals that better reflect the value of ancillary services and therefore provide a better investment signal), and increased reliability and efficiency. In that process, suppliers are also made whole to their next best opportunity.

Co-optimization is an integral piece of market dispatch fundamentals, which is why almost all ISO markets have some form of co-optimization in both the DA and RT markets. The remaining markets, ERCOT’s RTC+B in the RT and ISO-NE’s DASI project in the DA aim to incorporate co-optimization in 2025.

To understand the potential impacts of ERCOT’s RTC+B project on power trading and virtuals in the DAM, read “ERCOT RTC+B Day Ahead Trading Impacts” by Yes Energy’s Submissions Services expert, Daniel Cullen.

Yes Energy’s Market Monitoring Team is tracking these upcoming market changes to ensure the data is available and ready for our clients upon implementation.

Want to learn more about how power markets work? Read our Power Markets 101 or subscribe to our blog.

About the author: Portia Gilman manages the Market Monitoring Team, a group that stays abreast of the ISO energy markets so you don’t have to. The team serves internal and external clients with regulatory market knowledge and subject matter expertise on the impacts to Yes Energy’s clients, data, and the energy industry as a whole. Previously, Portia was an analyst for ISO New England’s internal market monitoring group for over six years, specializing in compliance, price formation, SCED dispatch, and capacity market economics.

Share this

- Industry News & Trends (123)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- DataSignals (25)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)