Share this

Bitcoin Miners Diversify Revenue Streams with Demand Response Services

by Yes Energy

For years, traders have utilized market forces to drive grid stability. Many large consumers participate in the Electric Reliability Council of Texas’ (ERCOT) Demand Response Program (DRS) and earn financial incentives by voluntarily reducing their power consumption during grid stress events.

Participants in this program can engage directly in ERCOT markets by offering their resources or indirectly by curbing energy consumption in response to wholesale prices. This helps uphold system reliability, fosters competition, averts price surges, and incentivizes improved responsiveness on the demand side of the market based on wholesale price signals.

Traders have long played a pivotal role in coordinating and optimizing these demand response efforts on behalf of their clients, ensuring both grid reliability and financial rewards for participants. However, the recent news that ERCOT paid Riot Bitcoin Miners $31.7 million to shut down during an August heatwave using similar tactics sent ripples through the industry. The events caused Riot to release a press release clarifying the events.

What Happened With Riot

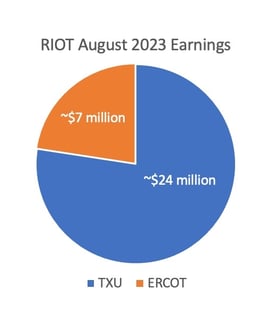

According to Riot Platforms, their Bitcoin mining and data hosting facility earned $7 million in revenue by participating in ERCOT's ancillary services program. This program functions via a competitive bidding system, where certain customers in the ERCOT market bid for the grid operator to remunerate them, somewhat resembling an insurance premium. This fee provides ERCOT with the ability to oversee the customer's electricity usage to ensure the stability of the grid. Furthermore, Riot's premium represents less than one percent of the program's overall funding, which approached nearly $1 billion within the specified August time period.

Riot also entered into long-term power purchase agreements, selling about $24 million worth of pre-acquired energy to its energy supplier, TXU Energy. TXU is a retail electricity provider and subsidiary of Vistra Corp., a publicly traded enterprise valued at over $12 billion. Because of economic efficiency, Riot didn’t use the energy it had purchased for business operations and instead sold it back to TXU in exchange for credits to apply to future energy bills.

Riot also entered into long-term power purchase agreements, selling about $24 million worth of pre-acquired energy to its energy supplier, TXU Energy. TXU is a retail electricity provider and subsidiary of Vistra Corp., a publicly traded enterprise valued at over $12 billion. Because of economic efficiency, Riot didn’t use the energy it had purchased for business operations and instead sold it back to TXU in exchange for credits to apply to future energy bills.

What Happened With ERCOT’s Extreme Conditions in August

As we headed into the summer of 2023, ERCOT predicted a historic base peak load of 83 GW due to system growth. There were concerns around generation capacity not being able to keep up, as well as historic amounts of renewable intermittent energy at play, which affects grid reliability and causes volatile electricity prices.

In June, ERCOT also launched a new ancillary service called Contingency Reserve Service (ECRS), which is designed to support grid reliability and manage grid uncertainty and variability. Essentially, ERCOT purchases ancillary services in the day-ahead market to balance the next day's supply and demand of electricity on the grid and mitigate real-time operational issues.

ERCOT hit extreme conditions multiple times over the 2023 summer. The ECRS, combined with ERCOT’s demand response programs, allowed ERCOT to get through the summer without any load shedding (i.e., distributing demand for electrical power across multiple power sources as a way of alleviating strain on a primary energy source).

All of these factors combined to facilitate financial opportunities for Riot and other large consumers such as steel mills, electrical battery companies, oil and gas companies, and power generators during stress grid events in August.

How the Right Data Provides Actionable Insight for Bitcoin Miners

Visibility into market dynamics is critical to facilitating those opportunities, and having the right data is an essential ingredient for those looking to utilize market dynamics to drive grid stability.

Let’s take a look at what happened in ERCOT this past August using Yes Energy® tools, which provide the most accurate and reliable energy data available.

"We chose Yes Energy’s PowerSignals solution to provide insights for our mining facility in West Texas. PowerSignals gives Cormint the tools to research wholesale power market dynamics like load, generation, price and congestion and make real-time decisions on power optimization strategies. These insights are critical for our day ahead and real time operations and power purchase decisions."

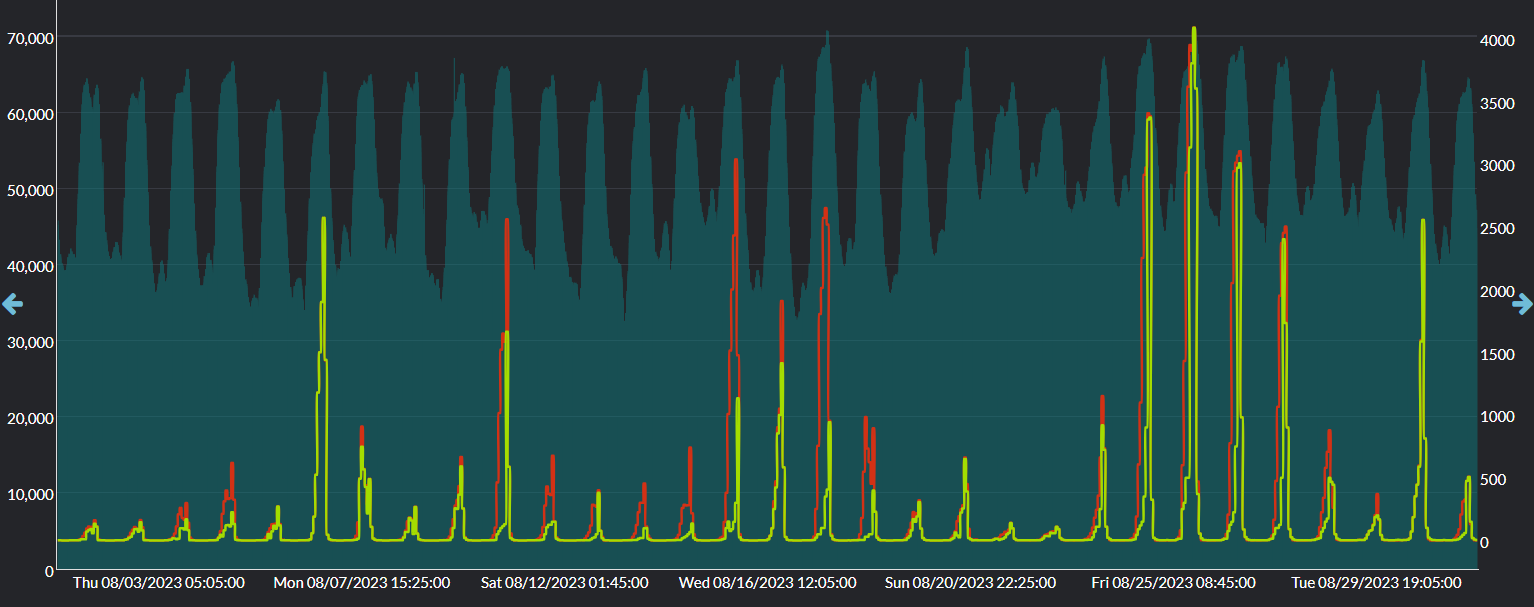

In the chart below, we see net load surpass 60 GW throughout the month of August. During these events, the ERCOT market paid hundreds to thousands of dollars per MW of ancillary service products for market reliability.

Day ahead prices for ECRS and RRS (yellow and red $/MW) ancillary products and Net Load for ERCOT (green bar chart).

During times of high grid stress such as these, customers participating in these ancillary service markets and other demand response programs are able to accumulate financial rewards by reducing their demand, offering much-needed stability to the electrical grid.

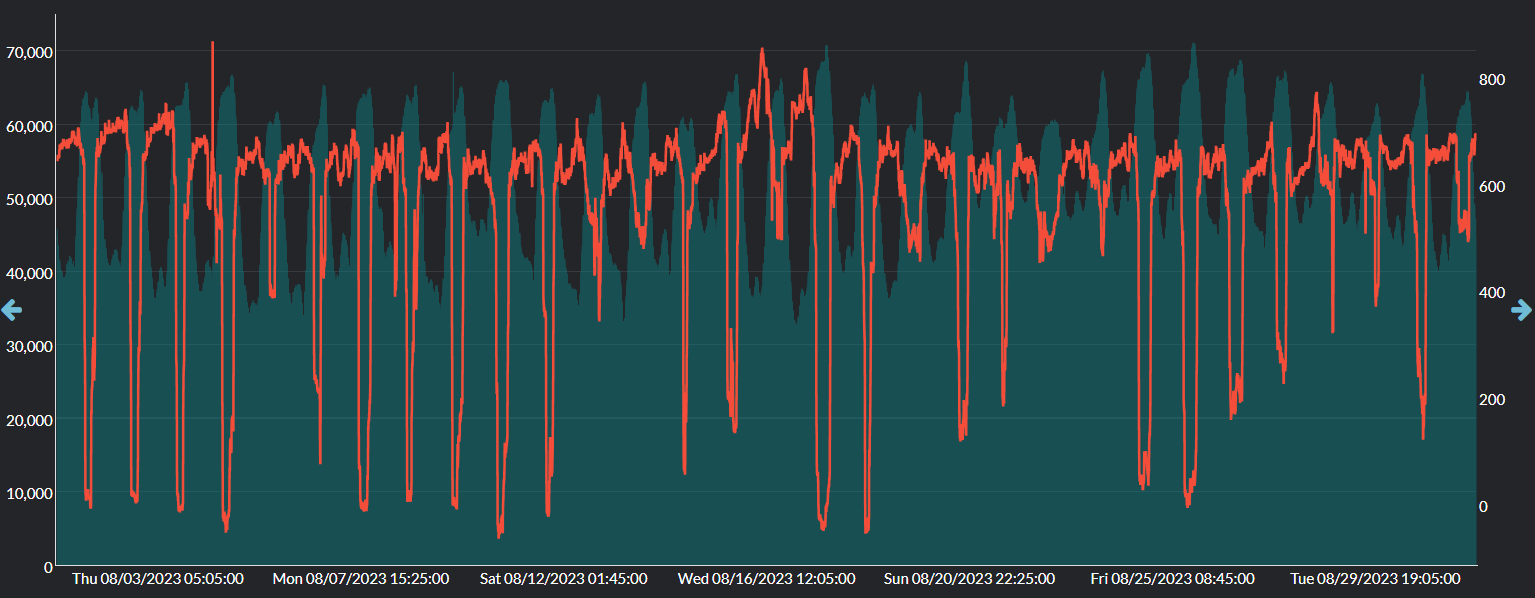

In the chart below, we use Live Power® real-time monitored data to track a large crypto mining facility during the same timeframe. The red line shows the facility consuming 600-800 MW at full load, then reducing their consumption during corresponding times of high net load demand on the system, as seen in the dark green background bar chart.

Large crypto mining facility Live Power monitored load (red) alongside Net Load for ERCOT (green bar chart).

Demand response programs and ancillary services programs allow data center owners and crypto mining operations to reduce their electricity consumption during peak demand and increase their consumption during off-peak times, allowing energy to be utilized that would otherwise be wasted. Identifying high net load is key for Bitcoin miners and other operators looking to facilitate financial opportunities as they help balance the grid in this way.

And it all starts with the right data.

Good data is an essential ingredient in driving grid stability. At Yes Energy, our products allow our customers to follow what’s happening on the grid with state-of-the-art, real-time, coast-to-coast transmission and power generation data.

How Yes Energy Can Help

Many industries participate in demand response programs and ancillary services markets, including steel mills, electrical battery companies, oil and gas companies, and power generation companies. Now Bitcoin miners can also participate in these initiatives and harness market dynamics to bolster the stability of the electrical grid.

At Yes Energy, we pride ourselves on the best power market data available – our data is constantly monitored and updated from public, partner, and proprietary sources, then cleaned and standardized for ease of use. We gather 750,000+ data collections and 110,000,000+ rows of new data per day, then deliver it as an integrated, complete data set so you can make informed decisions to bolster your bottom line.

Learn how Yes Energy can help you Win the Day Ahead™ by being your liaison into the power market. With billions of data points to navigate and million-dollar decisions to make, free up your time for what matters most.

Share this

- Industry News & Trends (122)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (24)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (3)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)