Share this

10 Things That Need to Happen to Enable the Energy Transition

by Yes Energy on Mar 23, 2023

Below is a redacted version of energy expert Peter Kelly-Detweiler’s keynote from our annual Summit.

In the past 25 years, competitive power markets have enabled much innovation, including fostering much of the solar, wind and battery integration into the market. Reliable, accurate, real-time data – what Yes Energy® provides – is the critical underlying fundamental that enables power markets. Within the next few decades, the data play around energy could become the largest data play in history, especially as we migrate into the low voltage distribution network and see distributed energy resources interacting with wholesale market opportunities and real-time situations on the ground at the localized network.

As we move forward on the decarbonization path, let’s look at some of the key elements we’ll have to identify and overcome, as well as how that will affect the power markets. We’ll need to make the right decisions in terms of investments and resources, supported by accurate and timely data that is converted into useful and actionable information. If we don’t get that right, we risk imperiling our transition to a clean energy economy.

As we move forward on the decarbonization path, let’s look at some of the key elements we’ll have to identify and overcome, as well as how that will affect the power markets. We’ll need to make the right decisions in terms of investments and resources, supported by accurate and timely data that is converted into useful and actionable information. If we don’t get that right, we risk imperiling our transition to a clean energy economy.

The Challenge: A Cleaner and Bigger Grid

As we move toward the decarbonization of global economies, electricity itself needs to become cleaner. Electrons will move everywhere, taking over sectors such as transportation, buildings, and heavy industry. In fact, meeting President Joe Biden’s decarbonization goals could triple future reliance on the electric grid, increasing the job of managing trading and risk dramatically as the electric space expands significantly within the next 10-20 years. However, there are multiple challenges standing in the way.

Big Picture Challenges

The first big challenge is the overarching issue of climate. Atmospheric chemistry is much more complex than just managing CO2, with deep policy implications. We’re fighting multiple emissions at once, with nitrous oxide 300x more effective at trapping the earth’s radiating heat than CO2 is and with methane about 25% more effective than CO2.

Second, supply chain issues continue to impact industries, with steel (for wind generation) remaining expensive, and multiple issues surrounding solar panels raising prices, including the Uyghur Forced Labor Prevention Act. Supply chain issues will continue to impact the ability to bring in more renewables – that trend will not go away immediately.

Third is the issue of money. Capital investment also remains  insufficient. Last year, for the first time, the world invested $1.1 trillion into the transition – roughly the same amount in green technology as in the hydrocarbon economy. However, Bloomberg and others estimate that we’ll need to triple that number to meet our 1.5-degree carbon target. While the financial spigot is flowing, it must open even wider than it is today. And recent events with Silicon Valley Investment Bank remind us of how sensitive the industry is to the financial sector.

insufficient. Last year, for the first time, the world invested $1.1 trillion into the transition – roughly the same amount in green technology as in the hydrocarbon economy. However, Bloomberg and others estimate that we’ll need to triple that number to meet our 1.5-degree carbon target. While the financial spigot is flowing, it must open even wider than it is today. And recent events with Silicon Valley Investment Bank remind us of how sensitive the industry is to the financial sector.

Fortunately, investment tax credits are stimulating a lot of domestic investment. Roughly $370 billion in the US has been earmarked for the transition. For the first time, we have an industrial policy focused on 50% wind and solar, modular nuclear, etc. However, unfortunately, we’re still picking technologies and sectors. As a trained economist, I believe it would be more efficient to target carbon and methane, then price that into the market, with the most efficient approaches winning. Instead, we pick winners and losers and implement tax subsidies.

Regulatory, Political, and Market Challenges

Regulatory issues remain at the fore. Interconnection queues are jammed and processes are slow, with new transmission build-outs limited. Independent system operators (ISOs) have been overwhelmed by the sheer number of requests, leading to a serious backlog in transmission. It takes about four years from the initial solar and wind requests to build out – historically, only 23% of what’s in the queue actually gets built. We’re simply not building out transmission facilities fast enough to accommodate all the new supply.

The Federal Energy Regulation Commission (FERC) is working on interconnection improvements as well as starting to fine transmission operators for not moving quickly enough in their interconnection studies, but the fines may not be enough to stimulate change. The FERC is also focusing on ways to get more regional transmission assets built, encouraging states to adopt 20-year planning timelines and agree on compensatory structures earlier in the process. These changes will take time.

Transmission rights of way (ROWs) and NIMBYism remain other big issues. Permitting new lines is a challenge, with public utility commissions often vetoing projects. One option may be using railways to bury lines, similar to offshore wind cables that are trenched below the seabed. Since railway owners own the rights of way, this would lead to one single transaction. Another option could be to use the 1950s Eisenhower interstate highway system to link up ROWs. Since every state owns its highway rights of way, we could bury transmission lines along the highways. Senator Ossoff from GA is currently championing this project. There’s a glimmer of hope with this option, but it will be expensive.

Gas, meanwhile, will continue to stay in the system – we’ll need it to accommodate the variables that come with renewables. For example, New Jersey is adding three new power plants, at least two of which will use natural gas. Tennessee Valley Authority, meanwhile, plans to retire coal and put gas in there instead, a 30- to 50-year capital investment. However, these types of investments incur a significant risk of having millions of dollars of stranded investments as economic damage continues to mount from advancing climate change. As that damage increases, so will the pressure on gas plants to retire prematurely.

Although gas prices have fallen significantly from last fall, we may be setting ourselves up for the next crunch. Most of the 100 billion cubic feet per day of dry natural gas that we produce comes from fracking, so we’ve got a good supply that’s fairly elastic – something we’ve gotten really good at in the last 15 years.

The challenge for pricing now is that we’ve also gotten really good at figuring out how to liquify and export natural gas. Within the next three to four years, the US liquified natural gas export capacity will grow as three additional projects begin construction, and we could be exporting as much as 20% to offshore markets, which are all very liquid. We literally now have a global liquid market for gas that we did not previously have. What that means is we are permanently adding a huge amount of fixed demand to the market’s supply/demand equation. All things equal, that puts upward pressure on prices.

Grid Planning and Operational Challenges

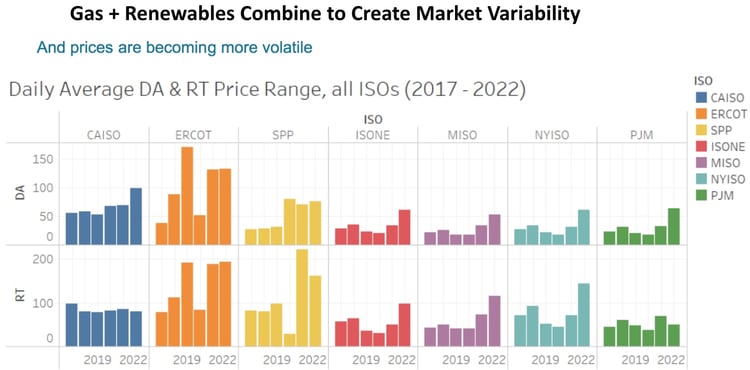

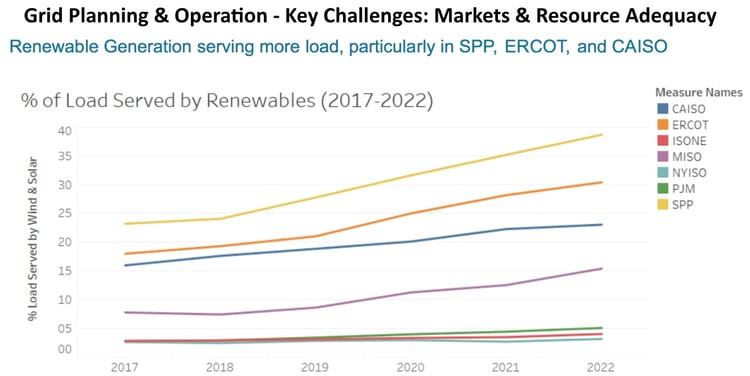

Resource adequacy has become a much bigger issue, as has the need for revised grid architecture. Renewables such as electric vehicles (EVs) are creating extra demand, but we’re not building out the infrastructure we need, creating the potential for much more market volatility – which then invites political push-back. Since variable renewables bring supply and price volatility, you need those other attendant resources (including batteries, which are great for frequency regulation), to balance load and intermittency.

As we continue to increase the volume of renewables on the grid, we have the short-term challenge of intermittency (i.e.: seconds and hours) as well as the longer-term challenges that happen over windless and cloudy days. The challenge of managing and balancing those resources (and the attendant inherent volatility around pricing) becomes more critical, as does being able to see that information in real time and respond with assets, so the markets function in the right way.

If you add more renewables into the grid without adequate transmission infrastructure, you increase negative covariance, decreasing the marginal unit for all those assets that were there before. This is a real challenge and why batteries are being used more frequently. All of this drives price variability.

Furthermore, as plants navigate the economic tightrope between shut-down and cold-start costs of their gas turbines versus the costs and benefits of selling power – or paying to offer power – into the market, this leads to an increase in negative pricing events. Congestion constraints exacerbate the issue at a nodal level. However, this volatility creates interesting opportunities for traders who can effectively manage their positions.

Other issues around resource adequacy include the need to address the entire ecosystem, particularly the impacts of each system on each other. We can't continue to operate the grid as a series of unrelated systems, fixing one at a time. If we don’t step back and look at everything holistically – especially as we triple the size of the grid – we run the risk of some serious failures. Extreme weather events like Winter Storm Uri, with its death toll of 246, epitomized this. We must recognize and regulate the system-to-system risks.

Finally, low-voltage networks will need new architectures. With FERC Order 2022, grid operators must now compensate distributed energy resource (DER) aggregators the same as any other asset in a wholesale market. We’ll start to see a meaningful interplay once we have EVs and frequency regulation and bidirectional flows from vehicles, like what’s beginning to happen in Germany with aggregations of vehicles providing grid balancing services.

In the US, we’re starting to see the first green shoots of those high-value opportunities. This year, 5.8% of all vehicles sold in the US were electric. According to a Bloomberg study of EV adoption paths in 18 other countries, every time a country went past 5%, it only took three to four years to get to 25% of new sales. By 2025, a quarter of our vehicles are expected to be electric. That kind of change causes a lot of opportunities as well as a lot of challenges, especially regionally.

We also need to be cyber-secure. Today, we have largely had an operational technology (OT) utility environment, where our industrial control systems (i.e.: data managing generators and transformers) have been relatively isolated and therefore easier to protect, but once we link it to an information technology (IT) environment (i.e.: the internet), it gets a lot harder. Hawaii is planning on 50% of energy coming from the customer side of the meter, which will need to be cyber-secure. So the data play is making sure that it’s a secure data play.

The future challenge will be to understand how this is unfolding, and where the vulnerabilities are, including demand response and distribution networks – especially on the West Coast and some parts of the East Coast, where they’re more swiftly incorporating renewables and DERs into the grid.

Summing It Up

We’re moving forward on decarbonization of the global energy economy because we have to, and because it often makes great economic sense. It’s why China has aggressively subsidized the solar industry with $40 billion so that it can dominate the space. Economic competitiveness – the struggle to control our energy futures – now moves very strongly into the sustainability area because it has to. We can’t back away from that; we must move forward.

The question then becomes how do we think about this in new ways that are more flexible – systems-of-systems approaches informed by economics. We want to do this in the most efficient ways possible. Informed economics in any market, combined with good policy, get you to the right places faster and more efficiently than any command and control approach ever will.

That’s where we stand today, with a huge challenge before us. A lot of new technology is coming on board, with many risks in front of us, huge opportunities for data plays, with pricing and market volatilities. It’s the most exciting – as well as most necessary – time to work in the energy space. Having healthy, adequate, informed markets that can provide signals to capital to move to the right places at the right times will help solve these problems.

Learn More

To learn more about energy expert Peter Kelly-Detwiler, connect with him or check out his bestselling book, The Energy Switch.

To learn how Yes Energy can help you navigate the energy transition with better power market decisions, schedule a demo today.

Share this

- Industry News & Trends (124)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- DataSignals (26)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- December 2025 (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)