Share this

Distributed Energy Resources: A State of the Market Report

What Are Distributed Energy Resources?

Distributed energy resources (DERs) are small-scale energy resources either in the form of supply-side resources like “behind the meter” solar (can be any small supply-side resources such as small wind, residential storage, etc.) or demand-side resources like EV charging stations that can curtail power demand (i.e., interruptible loads). Most DERs are around 100 kW, though they can range from 1 kW to 10 MW.

With heavy penetration of “behind the meter” solar energy in the US, we are seeing more and more DERs connected to the grid. Additionally, states like California and New York plan to ban the sale of new gas-powered vehicles by 2035. These aggressive goals will force the widespread adoption of electric vehicles, which will, in turn, increase the total interruptible load on the grid. With vehicle-to-grid technology, we can even expect emergency regulation resources (i.e., resources the ISOs use to maintain the grid frequency) on the grid in the near future from grid-connected EVs.

Our grid is not well equipped to handle DERs. From the inception of the electric grid, the emphasis has been on providing high-voltage and high-efficiency transmission from centralized sources of power (like a big nuclear or coal plant) to the consumer load zones. Historically, we didn’t have to deal with generating resources in the consumer load zones, and the ISOs didn’t have to deal with so many small generating stations in their footprint.

And since the number of DERs was negligible even a few years ago, ISOs did not have any tariff language that allowed these generators to participate in the market properly.

FERC Order 2222 Changes the Landscape

On September 17, 2020, FERC Order 2222 passed, enabling DER aggregators to compete in all regional, organized, wholesale electric markets. With FERC Order 2222, ISOs have to remove barriers for these DERs from participating in the market in aggregation. With aggregation, multiple DERs form a single entity (or aggregation) that can bid into the energy markets, and these aggregations make power flow models much easier to deal with than factoring for individual DERs.

DERs can avoid new generation investments by providing both energy and capacity. Distributed generation can meet local load needs, while load-modifying DERs (e.g., EE, storage, DR, and EVs) can shift load to avoid system peaks at specific times of the day and reduce the need for additional capacity investments.

We are seeing a stark increase in peak loads of ISOs in recent years. CAISO saw the single largest increase in peak load from last year at 15% – we need more energy in the coming years to keep our grids reliable.

All this means that the importance of DERs is at an all-time high.

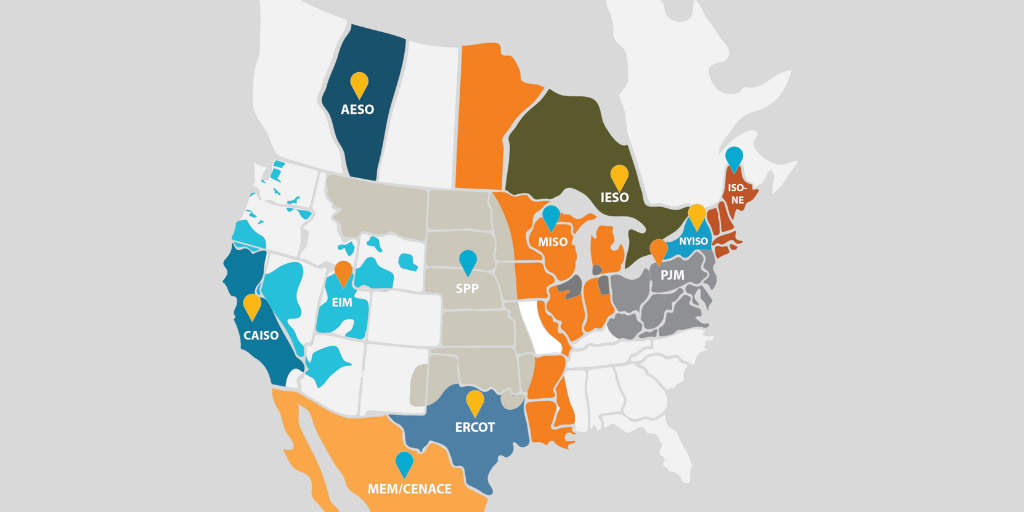

Let's look at the state of different ISOs in the integration of DERs in their market and how those may affect regional participation of the DER aggregators. This information is key for asset developers, aggregators, and traders to navigate these rapidly evolving markets.

NYISO

NYISO has been one the earliest proponents of DER aggregation in the industry. Prior to FERC Order 2222, it already had a separate FERC-approved DER aggregation integration proposal (filed June 2019, approved in January 2020). After FERC Order 2222, NYISO promptly filed its proposed tariff changes and became one of the first ISOs to have a fully approved FERC Order 2222 compliance filing with a planned implementation of later in 2022.

- NYISO set a maximum nameplate capability of a DER aggregated resource at 20 MW. It thinks it is in line with its interconnection queue process where small generators need to have a minimum nameplate capacity of 20 MW.

- NYISO has a minimum offer requirement for individual DERs at 10 kW.

- This is in stark contrast to what is seen in the other ISOs. This minimum DER capacity requirement essentially disenfranchises almost all residential rooftop solar in the state from participating in aggregation. For comparison, an average home solar installation in the US is 6 kW, although the numbers vary from state to state (e.g., in NC it is 8.5 kW; it is expected to be lower in NY).

- This essentially exposes a loophole that’s present with FERC Order 2222. Although there is an upper limit to what the ISOs can ask as the minimum offer from the aggregation (100 kW), there is no such upper limit in the order for individual DERs in aggregation. (ISOs can essentially keep this 100 kW and disenfranchise a large number of resources for the sake of convenience in their 2222 compliance.)

- NYISO has mentioned that it will be working towards lowering the minimum offer requirement from 10 kW for individual DERs once the market has been underway for some time.

- NYISO will follow the FERC-mandated tiered opt-in system, where small utilities (i.e., any utility that supplied less than four million MWh in the previous year) will need to opt in and be allowed by the regional retail regulatory authority to allow for DER aggregation.

- NYISO plans on working with the distribution utilities to improve communication and coordination between the ISO and the aggregators so that any new aggregated resource or any incremental change to an existing resource is communicated properly to all channels.

- NYISO will not be jurisdictionally responsible for DER aggregation interconnection queues. Instead, it will refer to the distribution utilities for feasibility studies and impact analysis. The distribution utilities will have 60 days to review the aggregation proposal (or any incremental change to an existing aggregation) before forwarding pass or fail (along with all their studies) to NYISO.

- Actual energy flows to and from the resources in the market will still be subject to NYISO’s own reliability standards.

- This follows FERC mandates that ISOs need to depend on distribution utilities for interconnection queue processing, feasibility studies, and impact analyses of DER aggregations.

- NYISO will refer to the aggregator’s self-attestation that they will not provide the same service in both retail and wholesale markets.

- This falls in line with other ISOs, who are also referring to the DER aggregators’ self-attestation.

CAISO

CAISO is the only other ISO to have FERC approve its Order 2222 compliance filing in 2022. CAISO had previously allowed DER aggregation to participate as demand response and had a case-by-case procedure for virtual power plants (VPPs) like Tesla. CAISO also had a FERC-approved DER aggregation program prior to Order 2222. With its compliance filing, however, CAISO plans on being fully compliant with FERC Order 2222 by November 1, 2024.

- CAISO has planned two separate models for DER aggregated resources, one for energy injecting DERs, and one for demand curtailing DERs.

- Following FERC Order 2222, CAISO has also not planned on allowing dual participation of resources on similar products in both retail and wholesale markets.

- In its initial filing, CAISO had a much higher minimum offer requirement (500 kW) for DER aggregated resources, but following the FERC order, it lowered it to 100 kW.

- CAISO plans on not enforcing strict telemetry requirements, unless the DER aggregation provides the ISO with power upwards of 10 MW or it participates in an ancillary services market.

PJM

PJM started its DER integration investigation as early as 2017, but full implementation of FERC Order 2222 is not expected before 2025 or 2026. Like all other ISOs, PJM had allowed DERs to participate in the market only as demand response (even if they were actually generating resources) resulting from FERC Order 719 and had a case-by-case procedure for all other “non-standard” DER aggregators like VPPs.

The only VPP currently operating within PJM’s footprint is The Elk Neck Battery Storage Pilot Program by Sunverge. It only has a capacity of 0.5 MW for three hours, but the initial responses to this project seemed quite favorable.

However, with their recent FERC Order 2222 compliance filing, PJM is opening up its market to DERs more broadly.

- PJM will open up its market to DERs (ranging up to 5 MW) in aggregation, and aggregators need to be able to make at least an offer of 100 kW in the market. 100 kW is the upper limit of what the minimum offer can be and is mandated by FERC Order 2222.

- PJM plans to have a new market participation model specifically for DER aggregators called the DER Aggregator Participation Model.

- PJM will not be jurisdictionally responsible for DER interconnection queues, and DER aggregators will need to work with local utilities and regional electric regulatory authorities to enter the market.

- DER aggregators will still need to register with PJM to participate in the markets, so they are highly encouraged by PJM for pre-registration coordination activities with the distribution utilities to determine the locational and data components needed for PJM to maintain grid reliability.

- The distribution utilities will have a 60-day window to review and analyze the proposed registration for reliability impacts.

- PJM plans to limit DER aggregators to a single point of interconnection in the grid in the energy market. This means that any DER aggregated resource that wants to participate in the energy market in PJM needs to be connected behind a single node in the model. This has drawn stark criticism from renewable energy advocates, but PJM believes it is necessary to actually run their Market Clearing Engine within five minutes. However, PJM plans to allow multi-nodal DER aggregation in capacity and ancillary markets.

- Single-nodal activities in the energy market essentially stop a vast majority of DER aggregators from effectively participating in the market, since by the very nature of DER aggregation, multi-nodal models are more suitable.

- PJM expects partial compliance with FERC Order 2222 by July 1, 2023, but full compliance is still expected only after February 1, 2026.

ISO-NE

ISO-NE only completed its FERC Order 2222 compliance filing on February 2, 2022, and it is still subject to FERC approval. ISO-NE has put a tentative market implementation date of November 1, 2026, for full Order 2222 compliance. The ISO plans on following the FERC Order 2222 quite closely.

- ISO-NE plans on keeping the minimum offer at 100 kW, keeping in line with FERC’s mandate.

- The ISO plans on opening up its capacity and energy markets to DER aggregated resources.

- ISO-NE plans on limiting the DER aggregated resources to a single-nodal model. Moreover, that single node will need to be the retail delivery point for the DER aggregated resource.

- The ISO will also depend on the self-attestation of the DER aggregators to stop dual participation in both retail and wholesale markets in the same product category.

SPP

SPP followed ISO-NE’s footsteps, filing their Order 2222 compliance on April 28, 2022, and it is still subject to FERC approval. SPP has a slated market implementation timeline of Q3 2025. Similar to ISO-NE, SPP also plans to follow the FERC mandates quite closely.

- SPP plans on keeping the minimum offer of DER aggregated resources at 100 kW.

- DER aggregations in SPP will only be allowed to participate in SPP’s energy market or operating reserve market.

- SPP plans on keeping the DER aggregations limited to single nodal participation.

- SPP will depend on the DERA’s self-scheduling of power and self-attestation of single participation to run their market clearing processes.

- Like all other ISOs, SPP will also depend on the distribution utilities and regional authorities to take care of the DER interconnection queues.

MISO

Recently, MISO has been heavily criticized for their surprisingly late implementation date in their FERC Order 2222 compliance filing. MISO only expects to have full compliance capability by the end of 2029 and thus has filed for a 2030 market implementation of what they call distributed energy aggregated resources (DEAR).

Like PJM, MISO also has had a significant penetration of “behind the meter” solar in recent years, but these DERs have only been able to participate in the market as demand response resources.

What sets MISO apart from the other ISOs is that MISO did not stop the states from opting their DER aggregators out of the wholesale markets, whereas other ISOs have put provisions in their tariff to stop the states from opting their DER aggregators out of the wholesale markets. This has left MISO with a limited fleet of such DEARs, since except Illinois, all other states in MISO opted out of DER participation and disallowed the aggregators to participate even as a demand response resource in the wholesale market.

MISO is also already in the middle of two big projects: one, upgrading their existing legacy software to modern standards, and two, accounting for better information flow and settlements of configurable units such as combined cycle turbines, etc. MISO expects to finish these projects by 2025 or 2026, and it plans to start working on integrating DER aggregators into the market only after that.

- MISO plans on removing the opt-out provision from their tariff so that states cannot stop aggregators from participating in both retail and wholesale markets.

- Full compliance with FERC Order 2222 in 2030 will bring MISO in line with the other ISOs within the next few years. They also will have a minimum offer limit of 100 kW and don't plan on opening their markets to smaller aggregators.

- MISO will also not be jurisdictionally responsible for the DEAR interconnection queues, and aggregators will need to work with regional distribution utilities to perform feasibility studies.

- MISO also plans on limiting DEAR to a single point of interconnection in the grid, and like SPP and ISO-NE, they plan to do so in all their markets.

- MISO also plans on only allowing self-commitment of DEAR in their market and has mentioned they will not provide output forecasts for DEARs.

- This falls in line with MISO’s emphasis on improving communication between the DER aggregators and MISO and explains why a large part of their work is dedicated solely to building infrastructure for data ingestion. Without proper output forecasts (which is also really difficult to implement with such a vast number of DEARs potentially in the market), MISO will need to heavily rely on the resource aggregators for accurate data to stop over or under-commitment.

Support for Rapidly Evolving Markets

We see that different markets are in different stages of DER integration. Updated information is key for asset developers, aggregators, and traders when participating in these rapidly evolving markets.

Yes Energy provides the most comprehensive, robust, and high-quality energy data and analytics tools available, empowering companies to navigate highly complex markets. We're supporting the renewable energy transition by providing unparalleled transparency into wholesale power markets with cutting-edge power market data and analytic solutions.

With Yes Energy, you can rest assured that our products will remain timely and relevant, effectively handling any and all changes the ISOs and the FERC introduce.

Share this

- Industry News & Trends (122)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (24)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (3)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)