Share this

Upcoming Changes to PJM’s FTR Peak Types for Nodal Power Traders

by Stephanie Staska on Aug 25, 2022

Yes Energy has been busy preparing for PJM’s peak type changes coming up. Learn more about these changes and Yes Energy’s effort to deliver them to our customers.

In the power market, financial transmission rights (FTRs) enable market participants to offset potential losses related to congestion on the grid. These are financial contracts entitling the FTR holder to a stream of revenues based on the day-ahead hourly congestion price difference across an energy path. As such, they’re a key asset for traders hedging risk and speculating in this market.

In March of 2022, FERC approved PJM Interconnection’s plan to make changes to their FTR peak types. After years of offering three peak-type products, it now will be offering four for the upcoming auction. This change goes into effect on September 1, 2022, with the October 2022 monthly auction.

What's Changed and What This Means for You

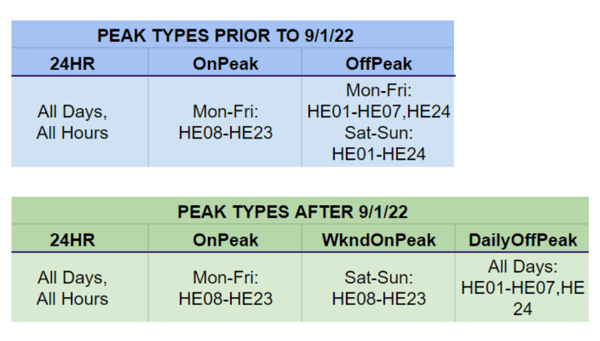

As of September 1, 2022, PJM will be splitting its OffPeak peak type into two new peak types: WkndOnPeak and DailyOffPeak.

The breakdown of hours for current as well as new peak types is below:

Starting with the October 2022 monthly auction, PJM will no longer allow OFFPEAK trades but instead will allow WkndOnPeak and DailyOffPeak trades.

With these peak-type changes, traders need updated tools to analyze historical performance and make adjustments to their trading models. Also, splitting the OffPeak peak type into two peak types will impact internal front, middle, and back office systems and processes. Therefore, it’s critical that the whole infrastructure is able to handle these changes.

Navigating This Change

At Yes Energy we’ve been busy preparing for this change on behalf of our customers. We made updates to enable our customers' ability to:

- Use our comprehensive suite of products to complete the analysis of your FTR trades and portfolios. This includes at least five years of historical data for the new peak types to enable your historical analysis.

- Update trading models to use the new peak types through our data products.

- Manage middle office needs, including trade capture, realized and unrealized profit and loss (P&L) calculations on the new peak types, and continued support of realized and unrealized P&L activities on existing OffPeak trades.

- Manage risk of FTR portfolios through a new FTR risk feature that delivers risk metrics through a user interface, API endpoint, and a customizable analytics engine that supports scenario analysis.

- Continue to use the OffPeak peak type in analysis, as the majority of PJM OffPeak ICE contracts, as well as many OTC contracts, will be following the old OffPeak peak type definition.

How We Can Help

Yes Energy provides the most comprehensive, robust, and high-quality energy data and analytics tools available, empowering companies to navigate highly complex and dynamic power markets to maximize their bottom line. As industry leaders in the nodal power market, we’re here to help you navigate the PJM Peak Type transition. To learn more, contact us.

.jpg?width=109&height=145&name=Stephanie%20Staska%20(1).jpg) About the Author: Stephanie Staska is the director of trade and risk products at Yes Energy. She has worked in energy risk management and compliance for the past 20 years, including time at Twin Cities Power, Cargill, and Split Rock Energy. Stephanie received her MBA and her bachelor's degreee in actuarial science and mathematics from the Carlson School of Management at the University of Minnesota. She enjoys traveling and spending time with her family.

About the Author: Stephanie Staska is the director of trade and risk products at Yes Energy. She has worked in energy risk management and compliance for the past 20 years, including time at Twin Cities Power, Cargill, and Split Rock Energy. Stephanie received her MBA and her bachelor's degreee in actuarial science and mathematics from the Carlson School of Management at the University of Minnesota. She enjoys traveling and spending time with her family.

Share this

- Industry News & Trends (123)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- DataSignals (25)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)