Share this

Understanding the February 2022 PJM Repricing Event

by Admin on Mar 07, 2022

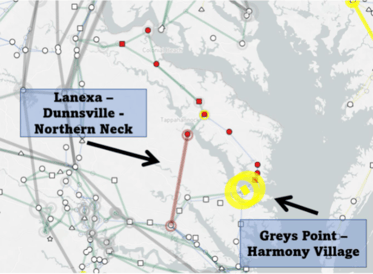

In this blog post we’ll break down the causes and ramifications of the reprice event in PJM for February 2022. The majority of the impact (both in the initial congestion and changes related to the repricing) was in the Northern Neck Peninsula in PJM.

The Northern Neck Peninsula in PJM can be prone to volatility and high prices due to its isolated location in the Dominion zone. There are only three lines that supply power to this region. One of the transmission lines (Lanexa-Dunnsville-Northern Neck) was placed on outage on January 5, 2022. The outage is expected to run well into 2023 while a second circuit is installed within this corridor.

As a result of the outage, the average DA Congestion Price in January 2022 was over $330/MWh within the Peninsula.

The line outage caused the Greyspoint to Harmony Village constraint (pictured above) to bind frequently - often oscillating between the regional marginal unit price and the Transmission Constraint Penalty Factor. The Transmission Constraint Penalty Factor is utilized when the available resources cannot solve for a transmission constraint. When it is applied, the price is set to $2,000/MWh.

As a result of the likely sustained nature of the constraint and the high cost to load in the Northern Neck area, PJM requested a revision to its tariff with FERC that would stop the application of the Transmission Constraint Penalty Factor. It would let the units (a set of small CTs) set the price and relax the constraint if needed. On February 18, 2022 the FERC accepted revisions to PJM’s tariff associated with the application of the transmission constraint penalty factor and also allowed the ISO to revise prices from February 1, 2022 as a result of the change.

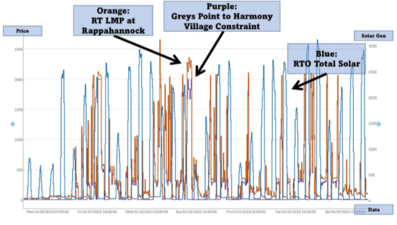

This is a unique situation and an outcome rarely seen before in the energy markets. PJM noted that the intention of the price signal created by Transmission Constraint Penalty Factor was to incentivize more elastic demand and bring more generation to an area, but given the cause and length of this congestion - there were few remedies and the only result would be high prices in the region. New generation is planned in the area; however, PJM believed it is unlikely this generation would be online in time to alleviate the congestion. This constraint has bound before, but notably, when solar generation was higher and provided additional MW relief in the area. As we can see in the chart below there is an inverse relationship between the constraint, pricing at a highly impacted node and solar generation.

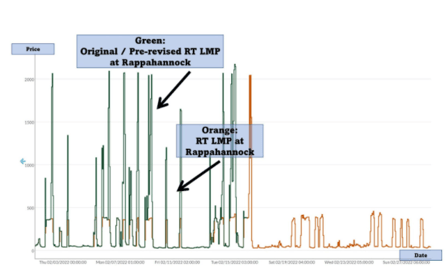

The new real time market pricing data (both hourly and five minute) has been loaded and is now available for analysis in Yes Energy’s solutions. Most nodes experienced a change in price. The example below shows the effect of the change on one of the most impacted nodes. This node alone had nearly 400 revised pricing intervals. The original price is considerably higher than the revised price. Pricing is currently coming in much lower than previously reported prior to the Tariff revision (pictured below).

As detailed by the following map, most nodes throughout PJM experienced a small change that rounded to $0. The Real Time LMP for the Northern Neck Peninsula nodes declined an average of $153/MWh over the time frame of 2/1/2022 to 2/17/2022.

If you’d like to run additional analysis of this data, check out the revised PJM Feb 2022 series in Yes Energy’s time series analysis and data solutions. Not a Yes Energy customer? Contact our team for a consultation.

Share this

- Industry News & Trends (123)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- DataSignals (25)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)