Share this

How to Optimize SPP Virtual Block and Slope Trading Strategy for Power Markets

by Daniel Cullen on Nov 29, 2023

Concerned about your SPP virtual portfolios and trades being suboptimal in terms of diversification and risk? As an energy trader, it can be challenging to align and optimize your portfolio to fully leverage and align to ISO trade definitions and available functions.

The Southwest Power Pool (SPP) market offers a unique set of functions for day-ahead traders to optimize their trading strategies and manage risk effectively with block and slope trade functionality.

What Are Block Trades?

Block trades enable traders to bid/offer for a fixed quantity of electricity at specific prices for a continuous block of hours.

This type of trade is useful when a trader anticipates that the price of electricity will be consistently high or low over a certain period of time.

What Are Slope Trades?

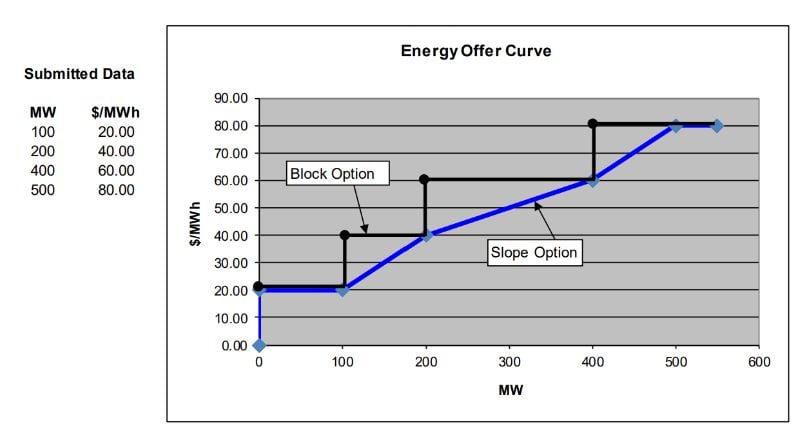

Slope trades are more complex and dynamic, enabling traders to bid/offer for a varying quantity of electricity at different price levels over a period of time. The quantity of electricity bid changes in response to the market price, following a predefined slope or curve.

The bid/offer price points in a slope trade serve as the values to interpolate a linear curve with the underlying megawatts then having various price points across the curve.

The Benefits of a Solution for Block and Slope Trades

Using the available functionality of block and slope trades in the SPP day ahead (DA) market ensures that your portfolio is optimized to deliver results based on your trading strategy.

This provides a competitive edge, as you can better manage risk and tailor your trades according to your strategy. It also helps to avoid portfolios and trades that may be suboptimal or not balanced from a risk perspective.

Source: Market Protocols for SPP Integrated Marketplace

Yes Energy Can Help!

Submission Services takes the guesswork out of DA virtual and spread trade submission. It ensures you align to and fulfill ISO requirements with embedded block and trade functionality built directly in the submission process. This is all delivered to your front office through a visual portfolio analysis dashboard and an easy-to-integrate data API.

Our team of market experts stays abreast of ISO developments and ensures our solutions are proactively updated as required. This is all part of Submission Services providing exceptional performance in trade execution and validation. Put our knowledge and expertise to work for you so that you can keep the focus on maximizing your returns in the DA market.

Learn more about Submission Services today!

About the Author: Daniel Cullen has more than 10 years' experience in commodity and power markets. The majority of that experience focused on the development and delivery of performance and risk solutions. At Yes Energy, he serves as the product manager for Submission Services, Position Management, and FTR Positions Dataset.

Share this

- Industry News & Trends (124)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- DataSignals (26)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- December 2025 (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)