Share this

How to Leverage Wholesale Power Market Data As an Asset Developer

by Cliff Rose

Background

Asset developers are companies involved in siting and building generation assets on the power grid. The primary focus of US power developers is on wind, solar, and energy storage projects, which benefit from:

- Corporate demand for CO2 offsets

- Higher fossil fuel prices

- Recently enhanced federal tax incentives (i.e., the Inflation Reduction Act)

The development process ends when construction capital is committed to a project (the financial investment date or “FID”). At that point, the project will likely proceed to commercial operation.

Achieving FID requires

Achieving FID requires

- completion of construction and operating requirements (e.g. land acquisition, permits, interconnection agreement, Energy Performance Certificates, etc.), and

- making a case for the revenue potential of the project in the local power market.

In the case of projects with power purchase agreements (PPAs), the asset developer makes the revenue case to the long-term buyer. In the case of merchant projects, the asset developer makes the revenue case to equity and debt providers.

In either case, the asset developer needs to demonstrate that power market fundamentals are attractive at the site. Typically, the revenue case involves backcast analyses at the site and long-term projections of price scenarios at the site.

A major competitive advantage for asset developers is siting projects with a better-than-average revenue case (i.e. siting their project where nodal pricing is more favorable). The effort to find the most favorable nodal pricing is complicated by the project’s operating constraints, such as wind/solar conditions, transmission capacity, land access, water rights, environmental issues, and regulatory framework. This means asset developers must assess the revenue case for many potential site options to find the optimal siting solution.

Three Types of Power Market Data Analyses

When a company is deciding where to site a power plant, it typically engages in three main analyses that deal with wholesale power market data.

- Market Fundamentals Analysis: Looking at historical pricing around a site, what drives those prices, and at a high level how prices might change in the future

- Price Forecast: A long-term nodal price forecast typically done by Powerflow modeling that accounts for changes to the generation and transmission system, typically performed by consultants

- Interconnection Study: A Powerflow-based study of feasibility and upgrade costs to interconnect the project, typically performed by consultants

Asset developers frequently engage consultants for a price  forecast and interconnection study; however, many will leverage power market data to perform their own market fundamentals analysis. At its core, a project siting market fundamentals analysis consists of:

forecast and interconnection study; however, many will leverage power market data to perform their own market fundamentals analysis. At its core, a project siting market fundamentals analysis consists of:

- Understanding historical prices around a site

- Drivers of those historical prices

- A high-level understanding of how prices might change in the future

Historical Price Analyses

Finding a Proxy Node

The first step in examining historical pricing is finding a suitable proxy node. For this, you typically want the closest node to your specific site, which GIS software with accurate price node and substation mapping can help identify. According to Jim McDowall, business development manager for Saft Batteries, “If you are two miles away from the substation … you could be losing 5% of your power between the energy storage system and the point of interconnection, and that is certainly an issue in terms of the power purchase agreement.”

Understanding Historic Pricing and Drivers

Once you’ve found your proxy node, you can analyze historical ISO pricing and market fundamentals data (i.e., load, generation, congestion, weather) to understand historic pricing and drivers at your proxy node. Typically, asset developers analyze two to three years of pricing and fundamentals data to tell the story of what prices have been and what has driven them.

To give a little more context, renewables developers typically look for sites of high wind/solar-weighted prices and favorable basis to an off-taker that are likely to stay that way. These developers usually use wind- or solar-weighted basis calculations. Energy storage developers typically look for sites with relatively higher price volatility that can reasonably be expected to stay that way. These developers typically use volatility metrics such as daily price spreads to inform their decisions.

Accurate and reliable data is key for better decision-making. At Yes Energy, that’s why we focus on providing clean, complete, accurate, and reliable data.

Future Price Trends Analyses

Once they understand historical pricing and drivers, asset developers need to explore how conditions on the grid may change in the future and how this might impact price. They can do this by looking at three fundamental factors:

- Planned/announced generation additions

- Planned transmission additions

- Long-term load growth forecasts

It’s critical to have accurate information on all three to directionally assess the future state of the grid and how it may impact your project. Planned and announced generation and transmission additions in particular can be difficult for developers to analyze, and often require either a vendor or in-house analyst to thoroughly assess interconnection queue and transmission planning data to understand grid change.

Using FTRs for Forward Pricing Analysis

Financial transmission rights (FTRs) are a tool used to hedge future congestion risk. Utilities, independent power producers, and speculative traders typically use them, but FTRs can give insight into how the market is pricing future congestion to help understand whether congested areas will remain that way.

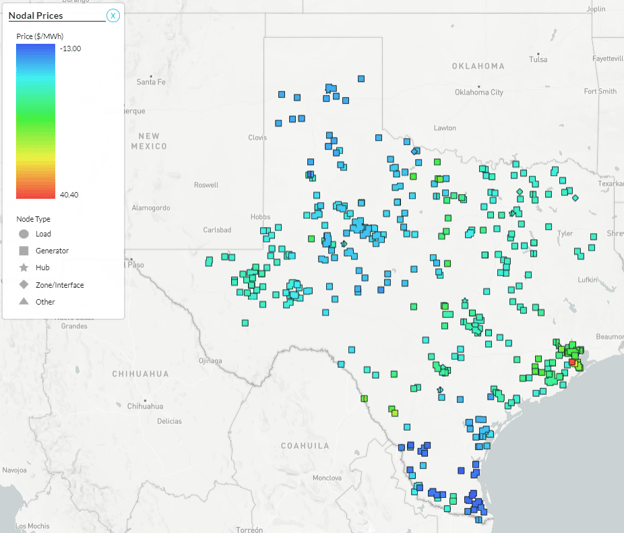

Below is a screenshot from Yes Energy’s tool, FTR Price Map, showing all ERCOT FTRs for 2025. As we can see, the market expects South Texas to have the most negative congestion in 2025 and the Houston area to have the most positive congestion.

In the example above, developers can visualize the congestion caused by FTR constraints across longer timeframes in order to help predict future growth – a critical part of the site analysis process.

Key Takeaways

The most critical elements of a market fundamentals analysis include finding the closest proxy node, analyzing historical pricing to see if it’s favorable, identifying the causal drivers of that pricing, then using forward-looking data including the interconnection queue, long-term load forecasts, and potentially FTRs to directionally assess forward pricing. All are essential to determining where to site a new generation project.

At Yes Energy, we deliver comprehensive nodal power market data as an integrated, complete data set with flexible options to ingest and analyze the data. This makes it quicker and easier for traders, power companies, and asset managers and developers to understand market developments so they can make the most informed decisions.

To read our in-depth analysis of how to use Yes Energy’s tools to conduct a battery sitting analysis, download our white paper here.

For more information on how Yes Energy® can help support your market fundamentals analysis, request a demo.

At Yes Energy, our teams are comprised of experts entirely focused on power market data. Yes Energy’s purpose-built tools allow you to easily analyze market moves with unparalleled front-end products so that you can spend your time acting on data, not aggregating it.

About the author: Cliff Rose is a senior product manager at Yes Energy currently focused on building products that help power plant developers leverage wholesale power market data in their decision-making. He has 12 years of experience helping companies navigate power markets in both a consulting and software development capacity. Outside of work, you can find Cliff engaging in stereotypical Colorado activities such as skiing, running, and biking.

About the author: Cliff Rose is a senior product manager at Yes Energy currently focused on building products that help power plant developers leverage wholesale power market data in their decision-making. He has 12 years of experience helping companies navigate power markets in both a consulting and software development capacity. Outside of work, you can find Cliff engaging in stereotypical Colorado activities such as skiing, running, and biking.

Share this

- Industry News & Trends (101)

- Power Traders (80)

- Asset Managers (41)

- Data, Digital Transformation & Data Journey (35)

- Asset Developers (30)

- Market Events (29)

- PowerSignals (28)

- ERCOT (27)

- Utilities (26)

- Infrastructure Insights Dataset (24)

- Market Driver Alerts - Live Power (24)

- Yes Energy Demand Forecasts (23)

- DataSignals (21)

- ISO Changes & Expansion (20)

- Live Power (20)

- Renewable Energy (18)

- Risk Management (17)

- Data Scientists (16)

- PJM (13)

- CAISO (12)

- Energy Storage / Battery Technology (11)

- QuickSignals (11)

- EnCompass (10)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Financial Transmission Rights (7)

- Snowflake (6)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Data Centers (4)

- FTR Positions Dataset (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- Commercial Vendors (3)

- Demand Forecasts (3)

- NYISO (3)

- data quality (3)

- AI and Machine Learning (2)

- Battery Operators (2)

- Canada (2)

- Europe (2)

- IESO (2)

- Independent Power Producers (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- Japanese Power Markets (1)

- Natural Gas (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- April 2025 (8)

- March 2025 (4)

- February 2025 (10)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (10)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (8)

- March 2024 (6)

- February 2024 (9)

- January 2024 (4)

- December 2023 (4)

- November 2023 (5)

- October 2023 (6)

- September 2023 (2)

- August 2023 (5)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (3)

- March 2022 (3)

- February 2022 (6)

- January 2022 (3)

- December 2021 (1)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)