Share this

How to Begin Trading in Japanese Power Markets

Let’s explore the similarities and differences between the US and Japanese power markets and review some of the tools you need to begin trading in Japan.

Japan: the Fifth Largest Power Market

The five largest power markets in terms of consumption are:

- China

- United States

- European Union

- India

- Japan.

Of these, only the US, European Union, and Japan have fully liberalized power markets.

Japan is newest to the list, having fully liberalized in 2016. This means there is retail competition, a physical market (intraday, day-ahead, forward), and futures markets.

Japan’s size, market structure, seasonal climate, and island nuances make for a very tradable power market, attracting a range of global participants.

Japan is navigating market liberalization in tandem with the energy transition, creating lucrative opportunities for enterprising market participants. It's no surprise some of the largest, most sophisticated power trading shops are flocking to this growing market.

Whether you’re a retailer looking to minimize imbalance charges or a speculative power trader, Yes Energy Demand Forecasts (formerly TESLA) can help you Win the Day AheadTM in Japanese power markets.

Here’s how.

Japan Power Markets Versus US Power Markets

Different Frequencies, Constraints, and Units

Japan is divided into two grids: the East and West.

The Eastern (Hokkaido, Tohoku, and Tokyo) grid operates at 50 Hz, like Europe and most of Asia. The Western grid (Hokuriku, Chubu, Kansai, Chugoku, Shikoku, and Kyushu) operates at 60 Hz, like North America.

Not only is Japan an island nation without interconnection to other countries but there are significant constraints due to the different frequencies and high-voltage direct current (HVDC) connection limitations.

Given the complexities of the Japanese power grid and the wide range of variable factors, power traders look to fundamental forecasts to provide insights on the market. Yes Energy's Demand Forecasts for the Japanese power market are available in several aggregations to illustrate specific market viewpoints.

For example, since there is a large amount of solar in Kyushu but limited connection to the rest of the Western grid, we offer a Western grid forecast that excludes the Kyushu region.

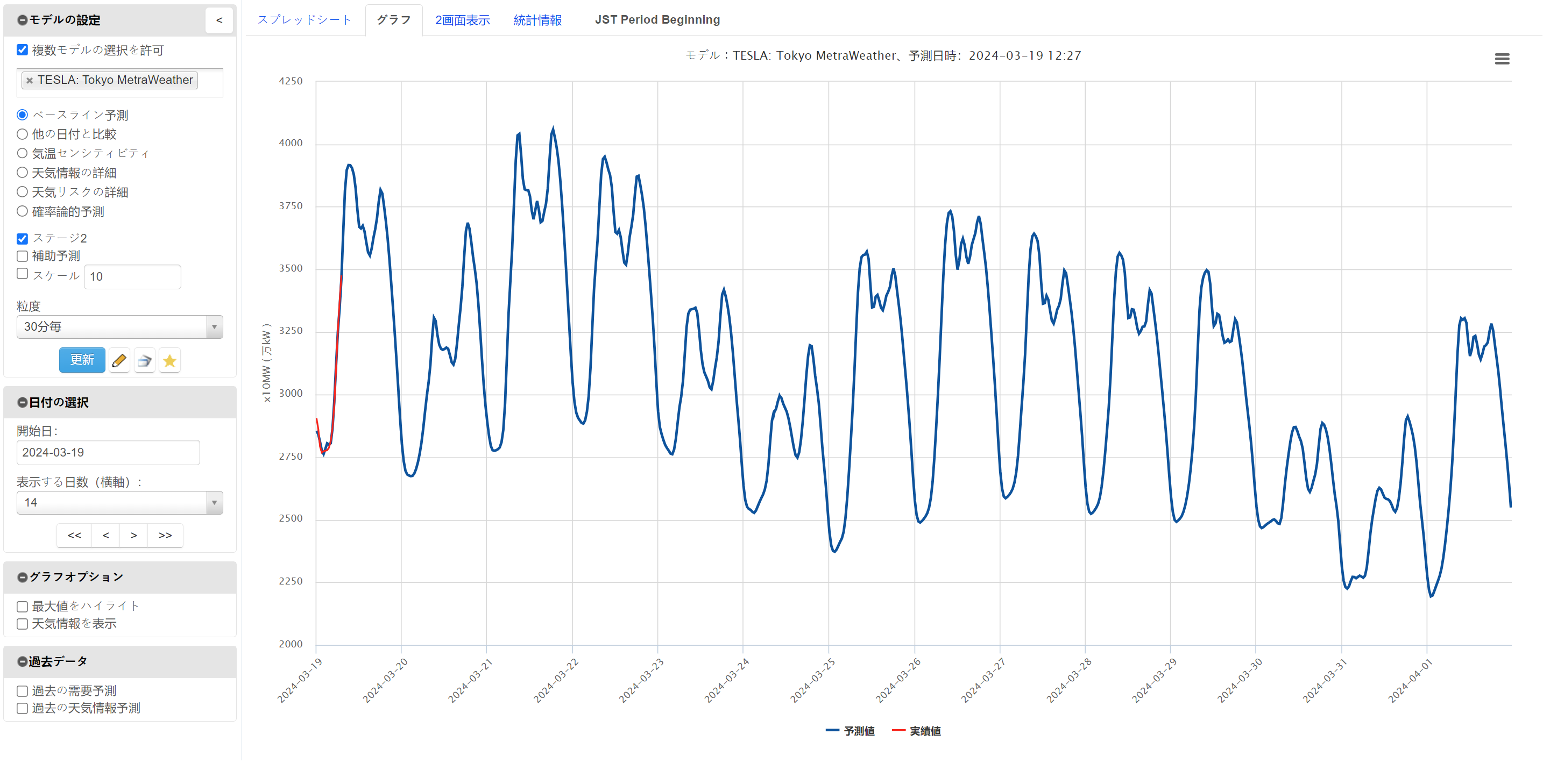

Notice in the graph below how the standard power unit in Japan is x10 MW, while in most other countries it is simply MW. This is because the Japanese convention is to use 10,000 kW, since there is a number for 10,000 (万).

Like most of Europe and Asia, the day-ahead Japanese power market is composed of 48 trading periods per day, while the US power market is composed of 24.

.png?width=2852&height=1418&name=Japan%20Power%20Blog_Image%201%20(1).png)

Source: Yes Energy Demand Forecasts

Nodal Versus Zonal Pricing

While the US operates several organized wholesale electricity markets, the Japan Electric Power Exchange (JEPX) is the single wholesale electricity exchange for Japan.

Although there is a single wholesale electricity exchange for Japan, there are still 10 (nine interconnected transmission system operators plus Okinawa) regional transmission system operators (TSOs) consisting of the incumbent utility companies.

The Organization for Cross-regional Coordination of Transmission Operators (OCCTO) acts to operate transmission across the regional TSOs, promote cross-area infrastructure investment, and coordinate nationwide supply and demand.

This differs from the US where the Regional Transmission Operators (RTOs) and Independent System Operators (ISOs) also operate the wholesale electricity markets.

Japan has zonal pricing, with a separate price for each of the nine interconnected regions.

This differs from much of the US where nodal pricing exists.

Although nodal pricing provides more granular and accurate price signals, it requires detailed data on generation, transmission, and demand at each node.

Detailed and timely supply data has been an ongoing, albeit improving, issue in Japan. TSOs have little incentive to make this data available, so they are following the orders of the regulator, the Ministry of Economy, Trade and Industry (METI). After all, the legal unbundling of the transmission and distribution sector did not happen until April 2020.

Given the data transparency issue, zonal pricing is currently the more appropriate option for Japan.

The Demand Forecasts are available for all nine regions.

Featured below is a snapshot of the two-week demand forecasts for Tokyo and Kansai taken in March. The two-week demand forecasts are updated every hour as new load and weather data become available.

Tokyo is the largest region in the East, while Kansai is the largest region in the West. These regions are especially important not only for their size but also because they are the benchmark contracts for Eastern and Western Japanese power futures.

.png?width=725&height=370&name=Japan%20Power%20Blog_Image%202%20(1).png)

Source: Yes Energy Demand Forecasts

Seasonality

Japan has four distinct seasons, making the demand forecast particularly important in both the winter and summer.

Tokyo’s summer power demand last peaked at 59.3 GW in August 2022.

Its winter power demand last peaked at 53.7 GW in January 2022. Although air-conditioning usage drives peak demand higher in the summer, average demand is higher in the winter.

.jpeg?width=3500&height=2147&name=AdobeStock_262854655%20(1).jpeg)

Japan’s power generation mix is very heavy on natural gas and highly depends on imported liquified natural gas (LNG). Given this and the fact that a large amount of natural gas is used for residential heating and industrial processes, the winter demand forecast is a critical piece to understanding power prices.

It's also important to be precise in the summer when the grid is likely to become strained at times of peak demand.

The high penetration of renewable generation adds to this complexity – we’re no longer just concerned about cold days. We're now concerned about cold, cloudy, and calm days.

These varying weather conditions provide opportunities for savvy power traders armed with world-class demand and generation forecasts.

Featured below is the Weather Risk Percentile Forecast (daily peaks) for Tokyo through March 2025, highlighting the seasonality of the system. Weather Risk is especially useful for those trading longer-term futures products.

.png?width=2834&height=1448&name=Japan%20Power%20Blog_Image%203%20(1).png) Source: Yes Energy Demand Forecasts

Source: Yes Energy Demand Forecasts

Booming Futures Market Activity in Japanese Power Markets

You can trade Japan power futures via the European Energy Exchange (EEX), Tokyo Commodity Exchange (TOCOM), and Chicago Mercantile Exchange (CME) Group exchanges. The EEX market began in May 2020 and houses most of the futures trading activity.

Option trading is available via CME Group.

As of February 2024, the EEX had 70 trading participants almost equally split by foreign and domestic companies. Trading volume has surged with 18.3 TWh for all of 2023, but just January and February this year have already reached 12.2 TWh: 2/3 of 2023’s volume. Volume in the futures market has now reached one-third of the physical market.

Source: EEX

Generally longer-term focused, the EEX began offering Tokyo daily futures in 2023.

TOCOM has also just begun offering weekly futures. These shorter-term products mean accurate weather-sensitive demand forecasts are becoming increasingly important.

Renewables and Price Floors/Caps

While US power markets are accustomed to negative power prices, the Japanese power market has a floor of 0.01 JPY/KWh. Since there is so much solar power generation in Japan, an accurate solar generation forecast is crucial.

The Residual Demand Forecasts make it easy to see the overall demand picture. Residual demand, or net demand, is the system demand minus solar generation minus wind generation.

The JEPX also has a price cap of 200 Japanese Yen (JPY)/KWh (~US $1,340).

.png?width=739&height=367&name=Japan%20Power%20Blog_Image%204%20(1).png)

Source: Yes Energy Demand Forecasts

The table below summarizes some of the key differences between the US and Japanese power markets explained in this blog:

|

US |

Japan |

|

|

Frequency |

60 Hz |

50Hz and 60 Hz |

|

Leading Intermittent Renewable |

Wind |

Solar |

|

System Operation Model |

Pool Model (American Style) |

Balancing Group Model (European Style) |

|

Pricing |

Nodal |

Zonal |

|

Trading Periods |

24 |

48 |

|

Currency/Unit |

USD/MWh |

JPY/kWh |

|

Demand Unit |

MW |

x10 MW |

|

Physical Markets |

Intraday, Day Ahead, Forward |

Intraday, Day Ahead, Forward |

|

Retail Competition |

Some states |

Nationwide |

|

Futures Markets |

Yes |

Yes |

|

Financial Transmission Rights |

Yes |

No |

Note that this is not an exhaustive list of the differences between the two markets.

Explore the Tools to Trade in Japanese Power Markets

Multiple Weather Views

Since Japan is such a weather-driven power system, it can be useful to view load forecasts powered by multiple weather forecast vendors. MetraWeather, Data Transmission Network and Dataline (DTN), and Japan Weather Association (JWA) options are all available with Yes Energy Demand Forecasts Japan.

.png?width=2826&height=1466&name=Japan%20Power%20Blog_Image%205%20(1).png)

Source: Yes Energy Demand Forecasts

Multiple Languages

Yes Energy Demand Forecasts Japan is available in both English and Japanese.

Source: Yes Energy Demand Forecasts in Japanese

Conclusion

The Japanese power market is the third largest fully liberalized power market in the world. Its size, market structure, weather sensitivity, and generation mix make it an attractive market for both domestic and foreign market participants. Yes Energy offers a range of forecasting tools to help you navigate this exciting new market.

Interested in learning more? Tune in to our webinar, What You Need to Know to Start Trading in the Japanese Power Markets, on demand.

Share this

- Industry News & Trends (122)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (24)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (3)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)