Share this

How Should Power Companies Assess Forecasts?

by Enertel AI

Forecasting is a fundamental part of security-constrained economic dispatch. Operators, traders, and asset owners need to know how the grid will change in the future and make decisions now in anticipation of those events – and they’re economically incentivized to do so. But what kind of forecasts exist, how do we know if they’re useful, and how can we use them more effectively?

What Forecasts Should I Be Using?

Forecasting in power markets is the programmatic delivery of predictions for a given horizon and with an associated value. Many forecasts are intertwined: weather is the foundational layer that influences load, solar, and wind predictions. Price forecasts generally follow, which combine gas and power futures data with transmission and plant outages. Other forecasts include binding constraints or asset-level generation.

We can measure the accuracy of these forecasts in different ways, but most practitioners would agree the top models combine the highest-signal inputs with the most performant predictive technology. Users of wholesale power market forecasts can use free versions from the independent system operators, build their own forecasts with data from vendors like Yes Energy, or purchase forecasts from third-party vendors. For any of the options, it’s important to assess the accuracy of the forecasts before committing financial resources to hiring new talent, building API connections, or developing ML infrastructure.

Accuracy Metrics

There are three metrics that people generally use to assess forecast accuracy: mean absolute error (MAE), mean absolute percentage error (MAPE), and mean squared error (MSE). Unfortunately, there’s no silver bullet and each metric can and should be used to assess different types of data series.

TIP: You may see mean squared error (MSE) and root mean squared error (RMSE) used interchangeably, the latter being the square root of the former. It’s safe to assume they have the same advantages and disadvantages.

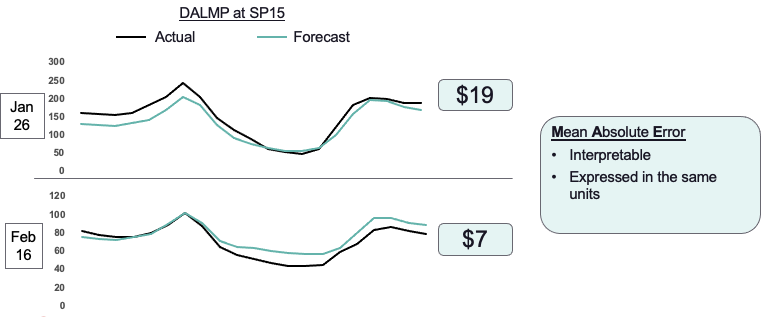

The mean absolute error is the metric that power traders and analysts are most familiar with, and it’s calculated by taking the average absolute difference between your forecast value and the actual value. It is the most intuitive answer to the question, “How far off are your forecasts from what actually happens?” It can also be very misleading when the scale of the actual values change, and it can downplay the importance of price or load spikes.

Example: The mean absolute error on two different days, one when gas prices were very high (late January) and two weeks later when they had depressed. Note the difference in scales.

Analysts who wish to control for the scale of the data series may calculate forecast accuracy using MAPE, which is calculated by taking the difference between the forecast and actual value as a percentage of the actual value. It’s relatable because it provides an indication for how far off your forecasts might be from the actual values as a percentage of the normal value from that series. Unfortunately, it’s a very poor metric to use for target series that approach zero, like most renewable generation forecasts and prices at hubs with a large penetration of zero-marginal-cost generation: zero is non-divisible, and missing forecasts close to zero can have an outsized impact on the metric.

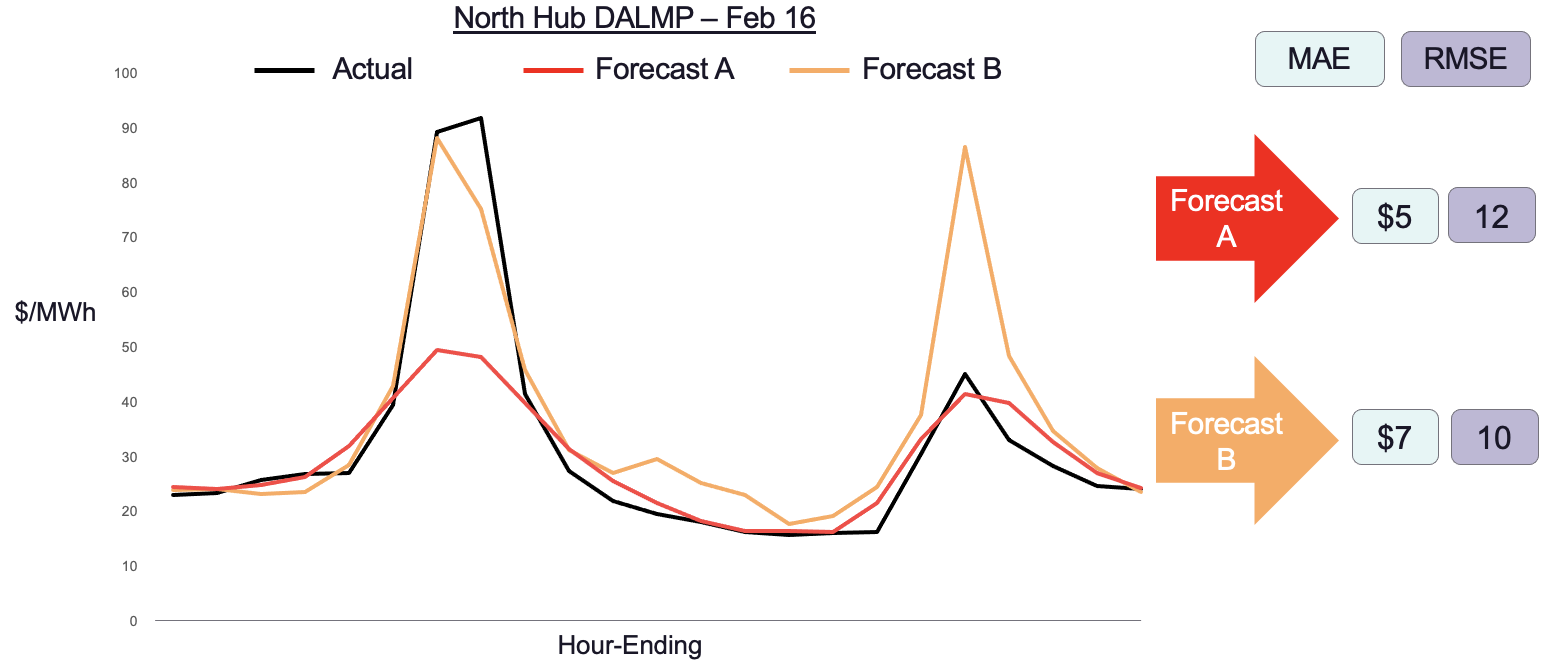

The last metric is the mean squared error, which is calculated by taking the square of the difference between forecasted and actual values, instead of just the difference or the difference as a percentage. By its mathematical formation, MSE can be impacted greatly by outliers. Unfortunately, even if we take the root of the MSE (RMSE), the metric still holds very little contextual value.

We demonstrate the value of MAE vs. RMSE in the below image. We have two forecasts: Forecast A does well on average but misses the morning peak prices. Forecast B is more accurate in forecasting the morning peak but performs worse during the day. Which forecast is better? It depends on the metric you use.

In power markets, most of the money is made or lost in the outliers. ERCOT traders are likely to benefit more from an accurate system-load forecast of 81 gigawatts versus one that does well during shoulder season. It follows that traders who select forecasts using MAE or MAPE may be overlooking forecasts that accurately predict the outliers.

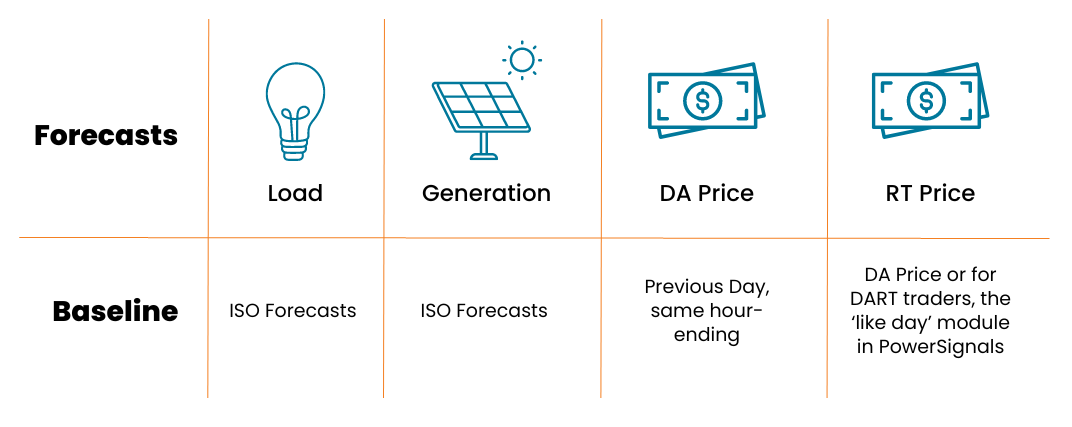

Use Simple Baselines

For every forecast that traders could build themselves or buy from a vendor, there’s a free baseline they can use to benchmark its accuracy. It can be tempting for traders or vendors to espouse the accuracy of their forecasts when the free benchmark for the same forecast might do just as well or better. In CAISO for example, where solar is so prevalent, the previous day’s clear can be a good predictor of the day ahead price for tomorrow because the ramp times are generally the same. Unless traders assess forecasts against the free baseline, they may be committing resources to intelligence they can get for free!

Simple Baselines

Conclusion

Forecasting in power markets will continue to increase in importance as more data gets collected and more AI tools are released to the market. It doesn’t have to be difficult to assess whether new tools are helpful or are worth the investment, but it can impact your profit and loss whether you use MAE, MAPE, or RMSE in your investment decisions.

Our recommendation for power traders? Assess all new forecasts for a reasonable amount of time using each of the metrics that make sense and compare its accuracy to a free alternative.

Enertel AI forecasts can be accessed in our PowerSignals®, QuickSignals®, and DataSignals® solutions. Want to learn more? Read about our partner Entertel AI!

Share this

- Industry News & Trends (122)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (24)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (3)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)