Share this

Winter Is Coming. Five Trends to Watch in the Natural Gas & Power Generation Markets

by Emily Merchant (Yes Energy) and Leticia Gonzales (NGI) on Oct 17, 2023

Yes Energy® and Natural Gas Intelligence (NGI) teamed up for a recent webinar to cover current and future trends in the natural gas industry and power generation markets. Discover their insights for the upcoming season.

Natural Gas Market Trends

Healthy Natural Gas Storage Inventories

Last winter, historically low natural gas inventories led to a spike in prices. Since then, prices have steadily declined due to a rebuild in storage inventories, including a milder winter that allowed storage inventories to recover.

We’re in a vastly different situation from last year, with storage inventories tracking well above historical levels, and Henry Hub prices currently trading around the $3/MMBtu mark. Natural gas supplies are expected to be adequate for the winter months, with natural gas prices expected to rise but not to 2022 levels.

However, weather continues to be the biggest wild card when it comes to affecting supply. As far as production goes, note that we’ve seen a huge decline in the drilling rig count, down 27% from last year.

When it comes to the demand side of the equation, we’ve seen an exponential growth in liquid natural gas (LNG) exports from 2016 on. Although we could see continued growth in the coming months, we don’t expect much additional growth until the latter half of 2024 into 2025, when we’ll see larger volumes of LNG demand coming online. This means prices aren’t expected to be impacted in the near future.

Growth in Gas Demand for Power Generation

When it comes to power generation growth for natural gas, the US Energy Information Administration (EIA) expects to see an increase of 3% year over year. As we head into an El Niño, that typically means a warmer than normal winter and drier than normal for most areas. However, that’s not the case in Texas, California, and some of the west. In Texas and some of the supply basins, weather is forecasted to be wetter and colder than normal.

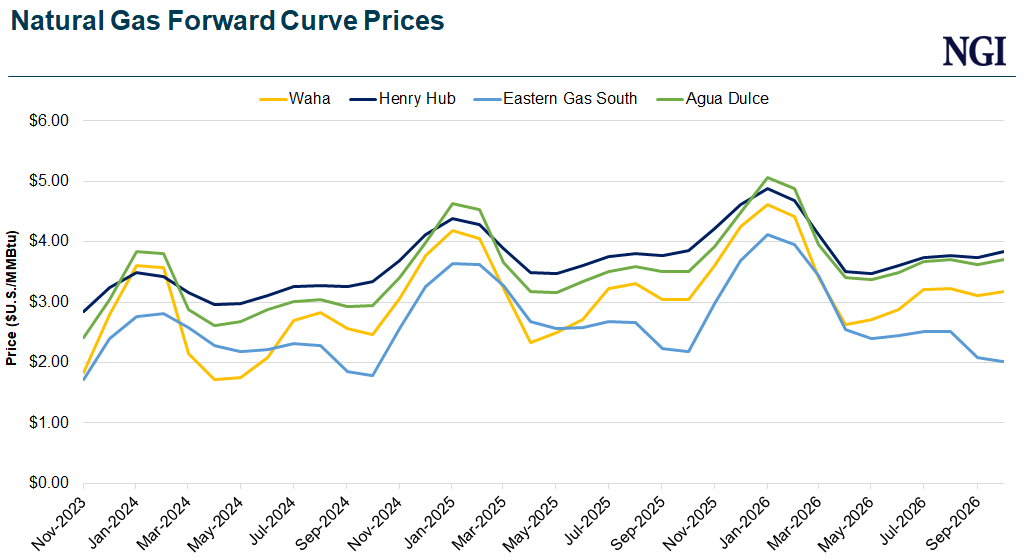

Next, let’s take a look at where the forward prices are going. As we mentioned, Henry Hub prices are expected to average in the $3 to $4/MMBtu range here throughout all of next year. Eastern Gas South represents the weakest price curve, with many bottlenecks still existing in that basin. Waha remains in a similar position until new pipelines come online and improve basin pricing. However, we do see large growth when Matterhorn Express brings 2.5 Bcf/d online, which should vastly improve prices in the region and improve gas flow out of that basin as well.

Source: NGI's Forward Look

Power Generation Market Trends

CAISO Is Shifting Away from Being the Dominant Importer of Generation

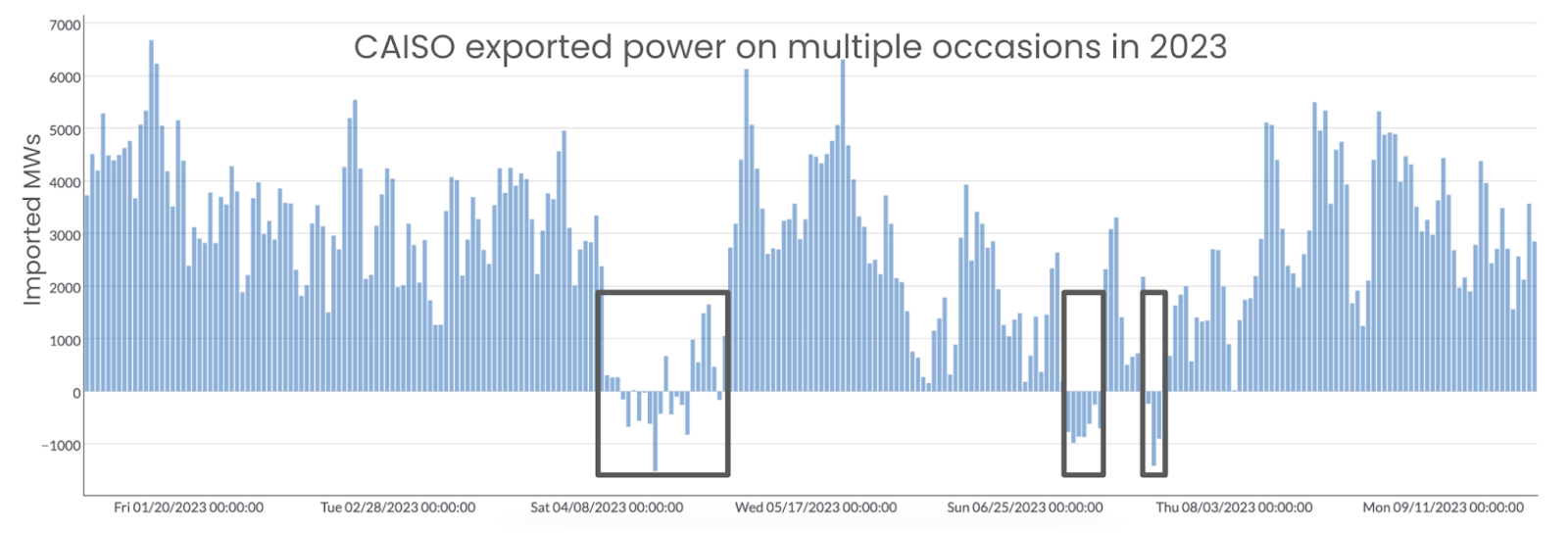

Historically, the California Independent System Operator (CAISO) has been a dominant importer of electricity generation, having to rely on surrounding areas to meet demand. That appears to be changing. Over the past year, we’ve observed CAISO as a net exporter at certain times during the year – a significant shift from historical trends.

Source: Yes Energy

This is because of three reasons:

- Lower gas prices have made it more economical for gas generators to operate and export generation to resource-deficit areas like the desert southwest.

- Increased hydro generation due to a healthier snowpack has allowed CAISO to export surplus generation to surrounding areas.

- Policy changes incentivizing clean energy sources have led to significant growth in the renewable and battery capacity industry, which results in excess supply during the day when the sun is shining.

Introduction of New Ancillary Products in ERCOT to Help with Reliability Challenges

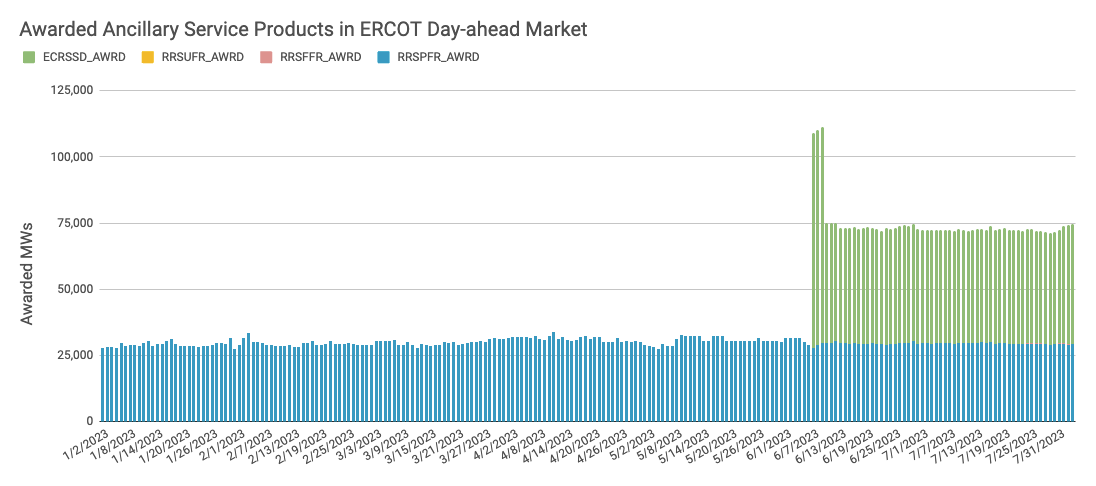

After the devastation caused by Winter Storm Uri in 2021, the Electric Reliability Council of Texas (ERCOT) implemented changes to increase reliability. Those changes include winterization of generation and transmission infrastructure, lowering the high systemwide offer cap from $9,000/MWh to $5,000/MWh, and offering demand response compensation based on nodal locational marginal price (LMP) instead of zonal LMP.

ERCOT has also introduced new ancillary service products for generators and load serving entities, including the recently-released ERCOT Contingency Reserve Service (ECRS), as a way to regulate frequency. Although record high temps and load in ERCOT this summer put the grid to the test, the new ancillary services products helped maintain reliability.

Source: Yes Energy

Shifting Congestion Dynamics in MISO

We've seen significant changes in the transmission congestion dynamics in the Midcontinent Independent System Operator (MISO) over the last few years because of the increase in renewable penetration. In the past year, this transmission congestion dynamic has cooled a bit due to wind capacity additions in MISO North and transmission infrastructure improvements connecting MISO North to MISO Central.

We hope to see a continued trend towards unlocking that renewable capacity in North MISO and flowing transmission more readily to MISO Central.

Learn More

Yes Energy partners with NGI to help our customers Win the Day Ahead™. Subscribers to Yes Energy and the NGI Daily Gas Index get access to that data in their Yes Energy products for no additional charge. Reach out to learn more about this partnership.

View the full Yes Energy/NGI webinar.

Share this

- Industry News & Trends (123)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- DataSignals (25)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)