Share this

Do We Have a Capacity Problem? Summer Outlook 2022

by Gaby Flores on May 31, 2022

Today is May 19th. We haven’t even made it halfway through the year, and we are already experiencing unprecedented weather conditions, record load, and resource adequacy warnings. Going into the summer, it certainly appears that transmission operators across the country may face challenges meeting load. Read on to learn more about some of the dynamics affecting the generation stack, ISOs, and ultimately consumers in this week’s blog post.

Hydropower Shortages

Last year, drought conditions affected California and other western states’ abilities to generate hydropower. Water levels dropped so low at the end of August that Hyatt Power Plant (the hydropower plant associated with Lake Oroville) had to shut down. This led to warnings of further rolling blackouts in CAISO (1).

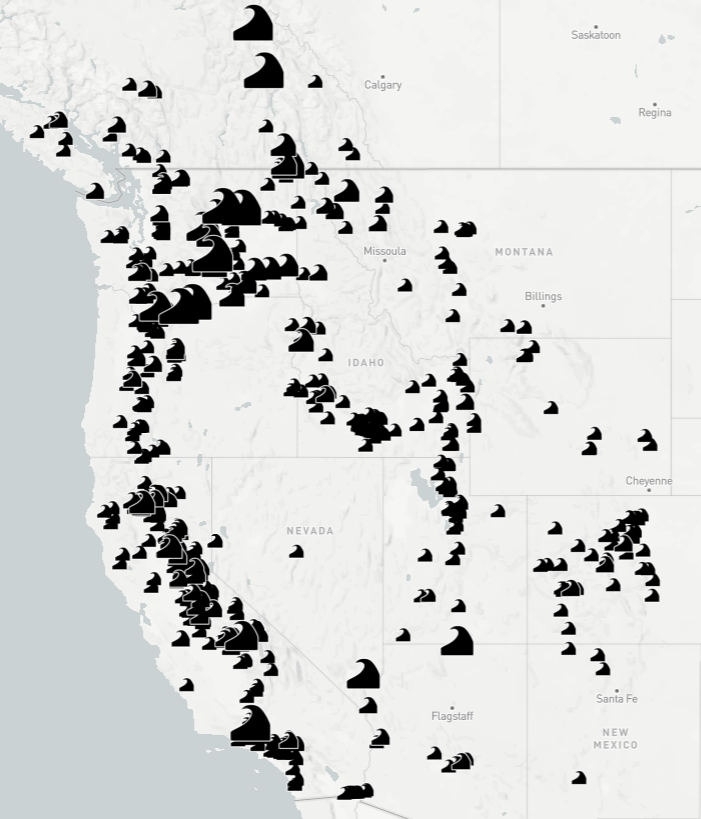

Summer hasn’t even kicked off yet, and the west is already facing significant challenges when it comes to hydropower generation because of drought throughout the region. During the first week of May, the federal government made the decision to hold water back from Lake Powell - a historic and unprecedented event. This decision is sure to have serious implications. By holding water back at the Glen Canyon Dam in order to ensure the plant is able to operate, access to water downstream will be limited, recreation will be seriously affected with the Colorado River so low and associated businesses are unlikely to be happy, and perhaps most significantly, there will be less water coming into Lake Mead and the Hoover Dam. While hydropower is only a portion of our generation mix in the west, should many hydro plants be out of commission due to drought it would seriously affect the ability to serve load during times of peak demand. Below, we can see all of the hydro-power in the west, illustrating just how problematic severe drought across the west could be to our power supplies.

Additionally, CAISO has struggled to meet peak demand and implemented rolling blackouts the last two summers due to increasing temps, intermittent sources of generation, and fear of sparking wildfires. CAISO tends to rely on imports from neighboring regions, so there’s a potential for them to be in real trouble if there is a lack of available capacity for import.

MISO Resource Adequacy Warnings

During the first week of May, MISO also made an announcement. The organization stated that even normal levels of demand and an average number of generation outages could be enough to necessitate emergency procedures this summer (2). Like CAISO, MISO is counting on the ability to import power from neighboring regions when necessary. This could potentially be risky should MISO experience extreme weather simultaneously with neighboring regions. While MISO has added more capacity year over year, the most recent additions are intermittent renewables which are less reliable and available than some of the thermal generators that have been retired in the region (3). Now, the ISO is anticipating a 5 GW peak shortage in July and a 2 GW peak shortage in Aust. The bad news? That’s the best-case scenario. Should MISO experience temps significantly higher than average the ISO could fall short of the peak July demand by a whopping 17 GW (2).

SPP

SPP recently announced that they anticipate having adequate capacity to meet demand throughout the summer (4). However, this came on the heels of a resource advisory for the following Friday and Saturday. The advisory was a result of higher than average temperatures, an uncertain wind forecast, and system outages. In SPP, resource advisories do not affect the general public, they are simply designed to alert generation and transmission operators so that they can act accordingly. The grid operator anticipates that demand will peak at 51.1 GW this summer and that they are prepared to serve 55.5 GW taking outages into consideration. However, much of the RTOs footprint is experiencing a drought, which might lead to a greater chance of high temps this summer (4).

ERCOT Heating Up EARLY

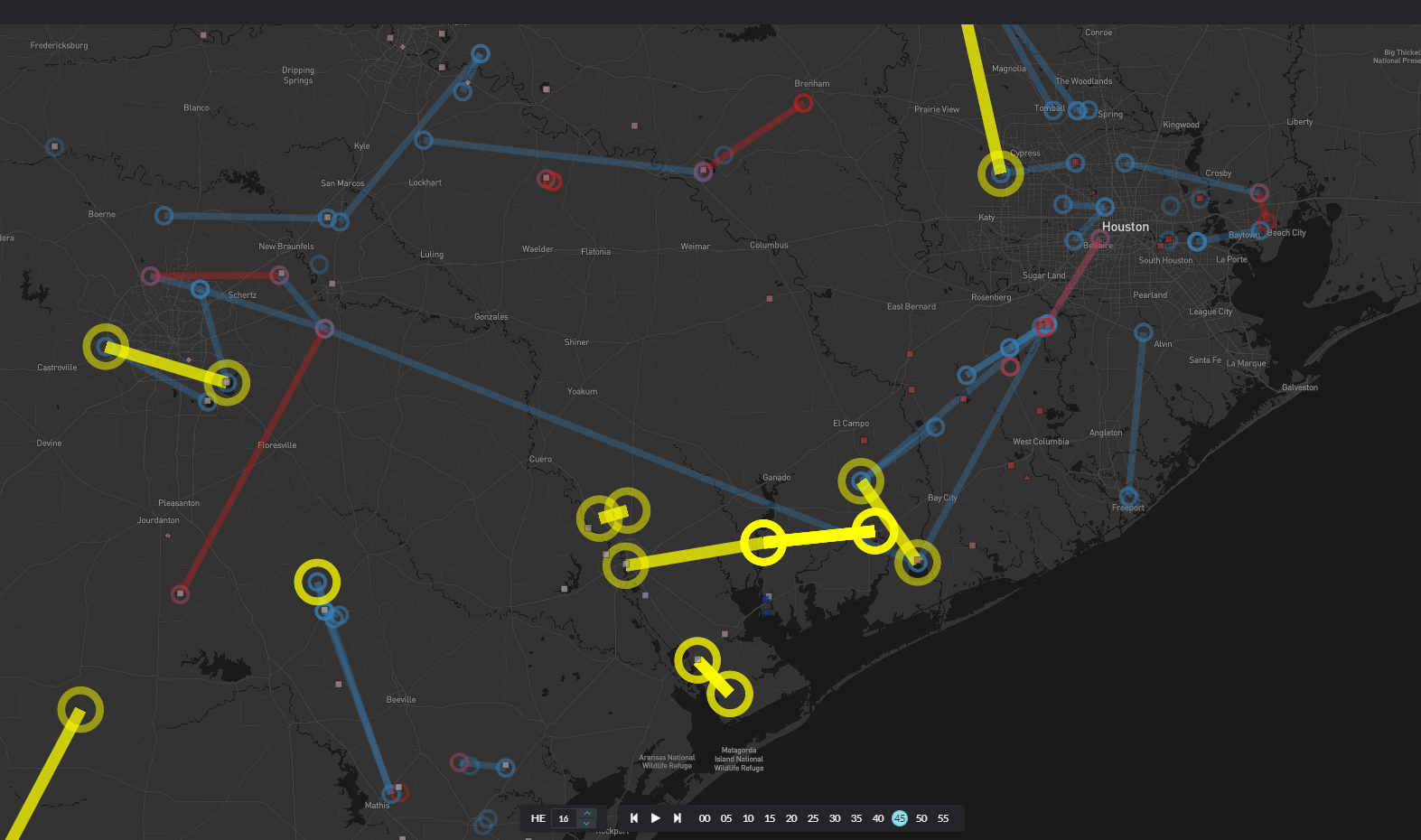

Last, but certainly not least, there’s ERCOT. This May, record-breaking heat has plagued the state. Last Monday, May 9th, ERCOT broke a peak demand record of 70.6 GW in the late afternoon, breaking the prior day’s record, which also broke the current June record. Prior to the heatwave, the RTO requested that generators, who intend to perform maintenance in May, postpone planned outages and come back to service (5). Below we can see that at 4:45 on the afternoon of May 9th, the real-time price at Houston Hub was $4,918.85/ MWh and $-1796,60/ MWh at Calhoun. We can also see significant congestion present in the area, likely exacerbated by the high temps.

As the week continued, ERCOT continued to feel the heat. On Friday, May 13, six generators accounting for 2900 MW of power tripped offline. The transmission operator subsequently requested that customers conserve power and set their thermostats above 78 degrees. Prices once again came against the price cap of $5,000 in the Houston area, and in the $4,000 to $5000 range across ERCOT. It is quite early for ERCOT to struggle to meet demand and for prices to spike so high. While driven by extreme heat, should the increased temps continue throughout the summer, ERCOT may be in trouble.

The Outlook, and the Importance of Data

Overall, it seems quite probable that the grid will face some reliability and capacity challenges this summer. This possibility is fueled by extreme heat, drought, increasing penetration of intermittent generation sources, and an aging grid.

As we go into the summer, it will be critical for traders and asset operators to stay ahead of the markets. Yes Energy is the leading energy market data solutions provider, and we have all the data you need to analyze the dynamics of the grid and make educated predictions about pricing, congestion, outages, and weather this summer so that you can perform to the best of your ability. To schedule a complimentary consultation or demo with one of our industry experts, click the button below and we’ll be in touch.

Resources

- https://www.cnbc.com/2021/08/06/california-shuts-down-major-hydroelectric-plant-amid-severe-drought.html

- https://www.rtoinsider.com/articles/30044-miso-warns-summer-emergencies-load-shedding

- https://www.rtoinsider.com/articles/30129-oms-letter-miso-resource-adequacy-concerns?utm_source=hootsuite&utm_medium=&utm_term=&utm_content=&utm_campaign=

- https://www.rtoinsider.com/articles/30119-spp-ready-long-hot-summer

- https://www.rtoinsider.com/articles/30096-insane-heat-thermal-outages-stress-ercot-grid?utm_medium=email&utm_campaign=Daily%20News%20for%20Paid%20%20Trial%20Subscribers%20on%205102022&utm_content=Daily%20News%20for%20Paid%20%20Trial%20Subscribers%20on%205102022+CID_cc32849f3822ca71c801f2a043125a7e&utm_source=CM&utm_term=postpone%20planned%20outages

Share this

- Industry News & Trends (123)

- Power Traders (86)

- Asset Managers (44)

- ERCOT (36)

- Asset Developers (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (31)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- DataSignals (25)

- Market Driver Alerts - Live Power (25)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (4)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)