Share this

What to Know About Data Center Growth, Energy Usage, and Efficiency

by Yes Energy

Data centers store, process, and manage large volumes of digital data and computing resources. Data centers house the necessary infrastructure for businesses, organizations, and online services to store and access data, run applications, and ensure reliable and high-speed network connectivity.

There are four primary types of data centers:

- Enterprise: built, owned, and operated by an individual company to meet its specific computing, storage, and networking needs

- Managed services: the company leases the equipment and infrastructure instead of buying it

- Colocation: the colocation data center hosts the infrastructure, while the company provides and manages the components

- Cloud or hyperscale: massive, centralized, custom-built facilities operated by a single company, such as Google or Amazon Web Services (AWS).

Data Center Energy Use

Data centers are inherently energy-intensive due to the enormous scale and complexity of their operations. This is mainly because they provide power and cooling for numerous servers and networking equipment responsible for processing and storing massive amounts of data.

Due to the increasing use of cloud computing, artificial intelligence (AI), and data-driven applications, data centers are increasingly using more electricity. And since data centers operate 24/7, they need a constant supply of energy.

The energy required for cooling can account for a significant portion of a data center's overall energy consumption. As servers process data, they generate heat, and effective cooling is necessary to prevent overheating and to ensure the reliability of the equipment. Air-conditioning systems or liquid cooling (i.e., water) are employed to manage the thermal load.

Data centers are one of the most energy-intensive types of buildings, consuming 10 to 50 times the energy per floor space of a typical commercial office building. Collectively, these spaces account for approximately 2% of the total US electricity use.

Data Center Energy Growth

The US accounts for roughly 40% of the global data center market. As the demand for data storage and processing power continues to grow exponentially, so does their energy consumption.

According to McKinsey, demand (measured by power consumption to reflect the number of servers a data center can house) is forecasted to grow approximately 10% each year through 2030, reaching 35 gigawatts (GW) by 2030, up from 17 GW in 2022.

Source: https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/investing-in-the-rising-data-center-economy

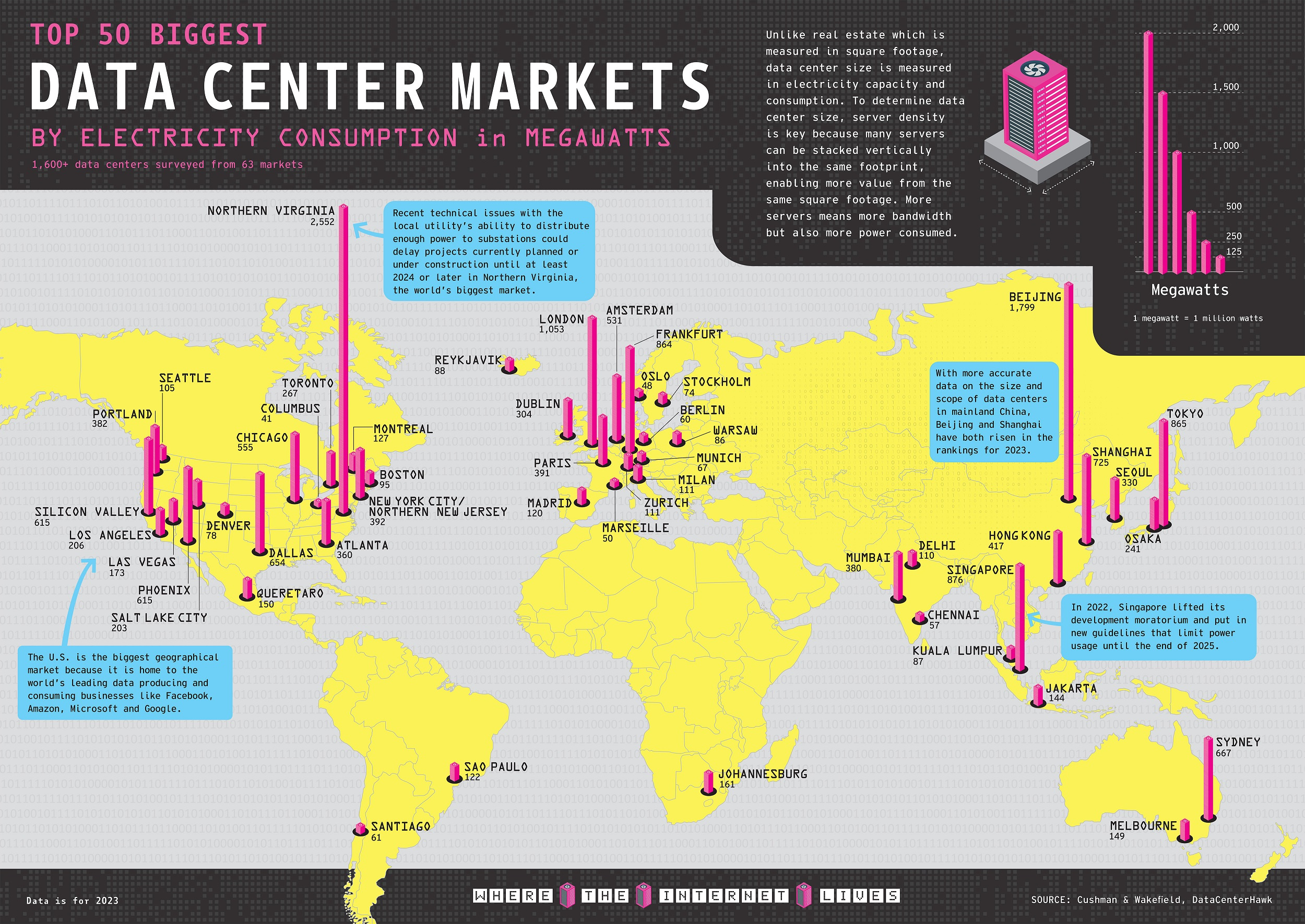

The Northern Virginia data center market is the largest in the world, with nearly 300 data centers, including many Amazon Web Services (AWS) servers. Data centers in the region are estimated to handle more than one-third of global online traffic.

Source: https://www.visualcapitalist.com/cp/top-data-center-markets/

Data Center Energy Challenges

The challenges facing data centers are many and include data privacy and compliance, interconnectivity, technological advancements, cost management, and security threats. Data center energy usage is also a primary concern.

Scalability and Legacy Infrastructure

With the increasing volume of data and demand for services, data centers must continually scale their infrastructure to handle growing workloads. Ensuring seamless scalability while maintaining performance and reliability is a significant challenge.

In 2023, for example, Northern Virginia data centers had a combined power consumption capacity of 2,552 MW – four times the capacity of the Dallas (654 MW) or Silicon Valley (615 MW) markets.

As a result, the Northern Virginia data centers are driving significant and unexpected electricity demand. Loads have increased at an unprecedented rate, leading to an immediate need for large-scale transmission infrastructure upgrades.

Artificial Intelligence (AI) and Increasing Demands of Digitalization

AI poses its own unique challenges. Data centers will likely experience continued growth and expansion into new markets to meet the demands of digitalization.

Training AI models is energy-intensive, with consumption influenced by factors like model size, task complexity, and hardware. For example, the graphics processing units (GPUs) that trained GPT-3 (the precursor to ChatGPT) consumed 1,300 megawatt-hours of electricity, roughly equal to the amount of electricity used by 1,450 average US households per month.

This has prompted researchers to seek energy-efficient and environmentally sustainable AI training methods because of increasing concerns about environmental impact.

Cryptocurrency Data Center Electricity Consumption

Crypto mining is a process in which cryptominers unlock new cryptocurrency tokens, posing unique growth challenges to the data center conversation. The electricity requirements for cryptocurrency mining frequently exceed the power supply capacities of typical data centers, resulting in problems like circuit overloads and frequent downtimes. These issues can significantly impact profitability as well as hardware lifespan.

Since 2021, an influx of large-scale cryptocurrency miners have established operations in Texas, Georgia, and New York (see figure below).

Source: https://www.bloomberg.com/news/articles/2024-02-01/bitcoin-miners-in-us-consume-up-to-2-3-of-nation-s-electricity

According to the US Energy Information Administration (EIA), cryptocurrency miners represent at least 0.6% of all electricity demand in 2023 – that’s as much electricity as the state of Utah uses.

Data Center Energy Efficiency

Improving the efficiency of existing data centers and designing more efficient centers will be a key factor as we move forward. Increased regulation may also play a factor. Dublin, Ireland, and Singapore have already taken steps to control data center energy use, and the US may follow.

In the meantime, researchers are working on ways to address energy efficiency in data centers. For example, Massachusetts Institute of Technology (MIT) Lincoln Laboratory has implemented power constraints with their supercomputers, leading to a 30-degree Fahrenheit decrease in GPU temperatures, resulting in more consistent performance and reduced strain on their cooling systems.

Furthermore, the Lincoln Laboratory Supercomputing Center (LLSC) aims to mobilize green-computing research and promote a culture of transparency. "Energy-aware computing is not really a research area, because everyone's been holding on to their data," according to Vijay Gadepally, senior LLSC staff. "Somebody has to start, and we're hoping others will follow."

The EIA also plans to increase its collection of data for cryptocurrency miners in particular. From February to July of 2024, the EIA plans to conduct a survey focused on evaluating the electricity consumption associated with bitcoin mining.

Tracking and sharing data is an important starting point. For those interested in tracking energy infrastructure projects, Yes Energy’s Infrastructure Insights Dataset is the deepest and the most thoroughly researched database of all the energy infrastructure projects in North America.

To learn more about how the Infrastructure Insights Dataset can help you understand upcoming changes to generation, transmission, or demand, request a demo.

Share this

- Industry News & Trends (122)

- Power Traders (86)

- Asset Managers (44)

- Asset Developers (35)

- ERCOT (35)

- Infrastructure Insights Dataset (35)

- Data, Digital Transformation & Data Journey (33)

- PowerSignals (30)

- Utilities (27)

- Market Events (26)

- Yes Energy Demand Forecasts (26)

- Market Driver Alerts - Live Power (25)

- DataSignals (24)

- Live Power (23)

- Renewable Energy (19)

- Risk Management (18)

- Data Scientists (17)

- Energy Storage / Battery Technology (17)

- ISO Changes & Expansion (17)

- CAISO (15)

- EnCompass (15)

- PJM (15)

- QuickSignals (12)

- SPP (10)

- MISO (9)

- Position Management (9)

- Power Markets 101 (9)

- Submission Services (8)

- Data Centers (7)

- Financial Transmission Rights (7)

- Demand Forecasts (6)

- Snowflake (6)

- FTR Positions Dataset (5)

- Powered by Yes Energy (5)

- Asset Developers/Managers (4)

- Geo Data (4)

- ISO-NE (4)

- Solutions Developers (4)

- AI and Machine Learning (3)

- Battery Operators (3)

- Commercial Vendors (3)

- GridSite (3)

- IESO (3)

- Independent Power Producers (3)

- NYISO (3)

- Natural Gas (3)

- data quality (3)

- Canada (2)

- Europe (2)

- Japanese Power Markets (2)

- PeopleOps (2)

- Crypto Mining (1)

- FERC (1)

- Ireland (1)

- PowerCore (1)

- Western Markets (1)

- hydro storage (1)

- nuclear power (1)

- November 2025 (3)

- October 2025 (7)

- August 2025 (4)

- July 2025 (6)

- June 2025 (5)

- May 2025 (5)

- April 2025 (10)

- March 2025 (6)

- February 2025 (11)

- January 2025 (7)

- December 2024 (4)

- November 2024 (7)

- October 2024 (6)

- September 2024 (5)

- August 2024 (9)

- July 2024 (9)

- June 2024 (4)

- May 2024 (7)

- April 2024 (6)

- March 2024 (4)

- February 2024 (8)

- January 2024 (5)

- December 2023 (4)

- November 2023 (6)

- October 2023 (8)

- September 2023 (1)

- August 2023 (3)

- July 2023 (3)

- May 2023 (4)

- April 2023 (2)

- March 2023 (1)

- February 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (1)

- October 2022 (3)

- September 2022 (5)

- August 2022 (4)

- July 2022 (3)

- June 2022 (2)

- May 2022 (1)

- April 2022 (2)

- March 2022 (3)

- February 2022 (6)

- January 2022 (2)

- November 2021 (2)

- October 2021 (4)

- September 2021 (1)

- August 2021 (1)

- July 2021 (1)

- June 2021 (2)

- May 2021 (3)

- April 2021 (2)

- March 2021 (3)

- February 2021 (2)

- December 2020 (3)

- November 2020 (4)

- October 2020 (2)

- September 2020 (3)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (8)

- November 2019 (1)

- August 2019 (2)

- June 2019 (1)

- May 2019 (2)

- January 2019 (1)